The Week In Review: August 14-20

August 23, 2022

The Week In Review: Aug. 28 Sept. 3

September 6, 2022

No Pause In Sight

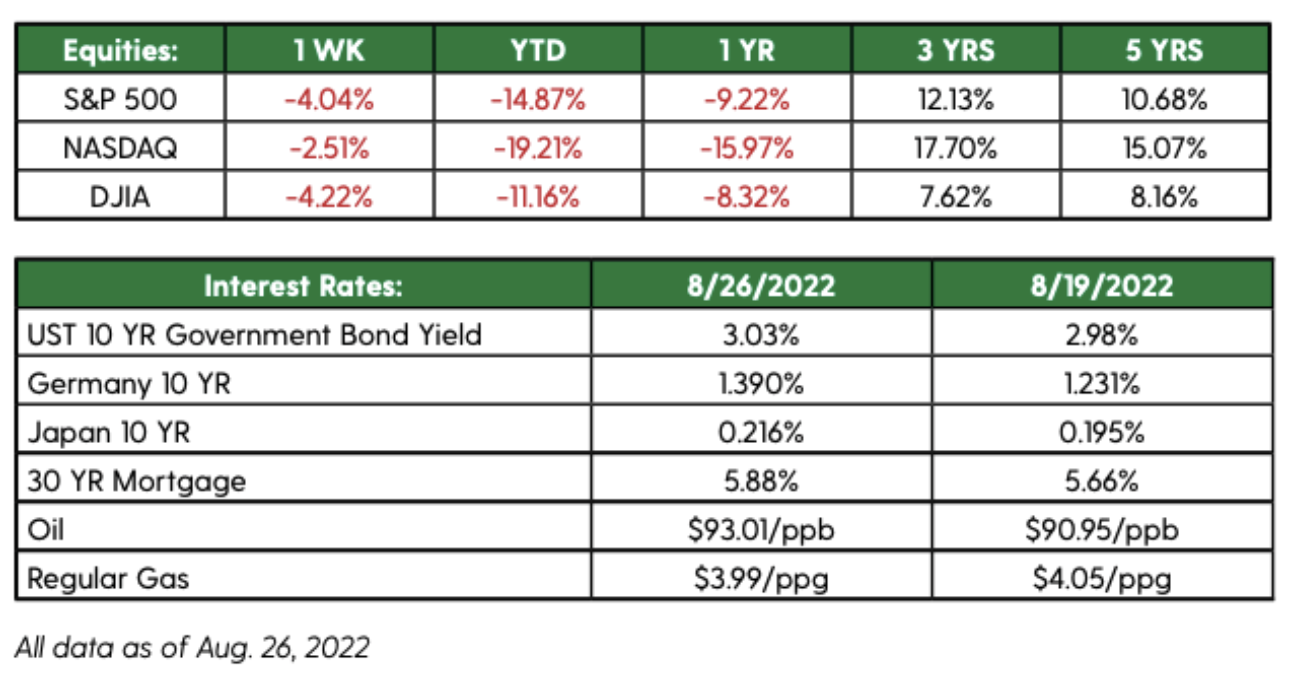

Markets eagerly awaited Federal Reserve Chair Jerome Powell’s comments at last week’s Fed symposium in Jackson Hole, Wyoming, anticipating a definitive announcement on the direction or magnitude of upcoming rate hikes. The equity markets were hoping for a lower increase in September and a possible pause in rate increases, as inflation appears to have leveled off for the time being. The bond market wasn’t so enthusiastic as the yield on the 10-year Treasury rose to — and remained above — 3% . (The last time the 10-year was at 3.5%, we were visiting the recent lows for equities in mid-June.)

All week, we heard both hawkish and dovish Fed members declare the need for more rate hikes, and the talk made markets edgy. Then, Chairman Powell delivered a similar message : The Fed is focused on lowering inflation, and there could be pain ahead as we continue on the path to lower inflation.

The speech took a lot of air out of the talk the Fed might pause after a rate hike. Markets were expecting a half-percent rather than a three-quarter rate increase in September, plus a pause for the Fed to reassess future rate hikes. We may still see a rate increase of 50 basis points in September, but the market was disabused of any notes the Fed would somehow pause and take a more dovish stance.

Markets started the week with jitters as the 10-year bond rose above 3%, and the specter of a different narrative than what markets were expecting began to emerge. Those jitters seemed to become full-blown disappointment following Chairman Powell’s comments, and markets experienced large drops for the week .

For now, the Fed is resolving to stay the course in its fight against inflation and doesn’t look as if it will pause rate hikes. Instead, the stock market will likely have to reassess its expectations. Markets seem to have rallied strongly from their mid-June lows; now, they need to step back and assess options going forward since the September pause is off the table.

One step forward, two steps back

Sometimes it’s good to step back and revisit recent policy decisions and how they’ve impacted our economy. The American Rescue Plan passed in March 2021 planted the seeds for the current levels of inflation. Spending money is one thing and spending it wisely is another. This decision may have been the biggest contributor to our current inflation trouble, but it didn’t bear fruit until a year later.

Inflation and fuel costs soared, and we began looking for “peak” inflation, the highest it can rise. Then the Build Back Better legislation returned in the form of the Inflation Reduction Act (IRA). The problem with the IRA is that it may only make modest steps to slow the growth of prices and won’t do so in traditional ways. Making matters worse, some of the biggest drivers of inflation were not addressed, such as food costs. The so-called “inflation reduction” would also not have any major effect anytime in the near future; instead, it will likely take years to see any impact from lowering the federal deficit.

Now, instead of wondering if the government has the discipline to lower the deficit by $300 billion in 10 years, we should have been wondering how long it would take the government to find a way to spend the savings it hadn’t yet collected. The answer was approximately three business days. Last week President Biden, via executive action, moved to forgive $10,000 of federal student loans for individuals making less than $125,000 per year. The cost of the loan forgiveness program? $300 billion .

Despite the efforts of the Fed to cool inflation, there appears to be no fiscal discipline on the government to help the Fed lower costs. That’s taking one step forward and two steps back.

- We’ll see a fair amount of data this week to gauge the health of the economy. On Tuesday, we’ll see the current job openings with the most recent Job Openings and Labor Turnover Survey (JOLTS). A positive here would be to see openings come down after hitting 11+ million earlier this year.

- The Standard & Poor’s/Case-Shiller home-price index will also be out Tuesday. It’s worth watching to see if prices are softening as the housing market slows.

- More employment news will be released on Wednesday, with the latest ADP employment numbers.

- Fed speakers will be out in full force this week, sharing their thoughts following last week’s Jackson Hole symposium.

- Finally, the August jobs report will come out on Friday. Forecasts are calling for an increase of 325,000 jobs. Last month we added 318,000 jobs, well above the expectations for 250,000.

Weekly Market Commentary 4/5/2024

Read more