Weekly Market Commentary – 2/23/2024

March 1, 2024

Weekly Market Commentary 3/8/2024

March 8, 2024

The S&P 500 and the Dow Industrial Average forged new all-time highs despite investors taking profits early in the holiday-shortened week. Semiconductor stalwart NVidia’s fourth-quarter earnings results induced a massive rally in the stock and brought the rest of the market along with it. The Company meaningfully beat street expectations and raised guidance above the current consensus. The move on Thursday tacked on over 200 billion in market capitalization and catapulted the company’s value to north of $2 trillion. The markets also digested the news that Capital One would takeover Discover for $35.3 billion.

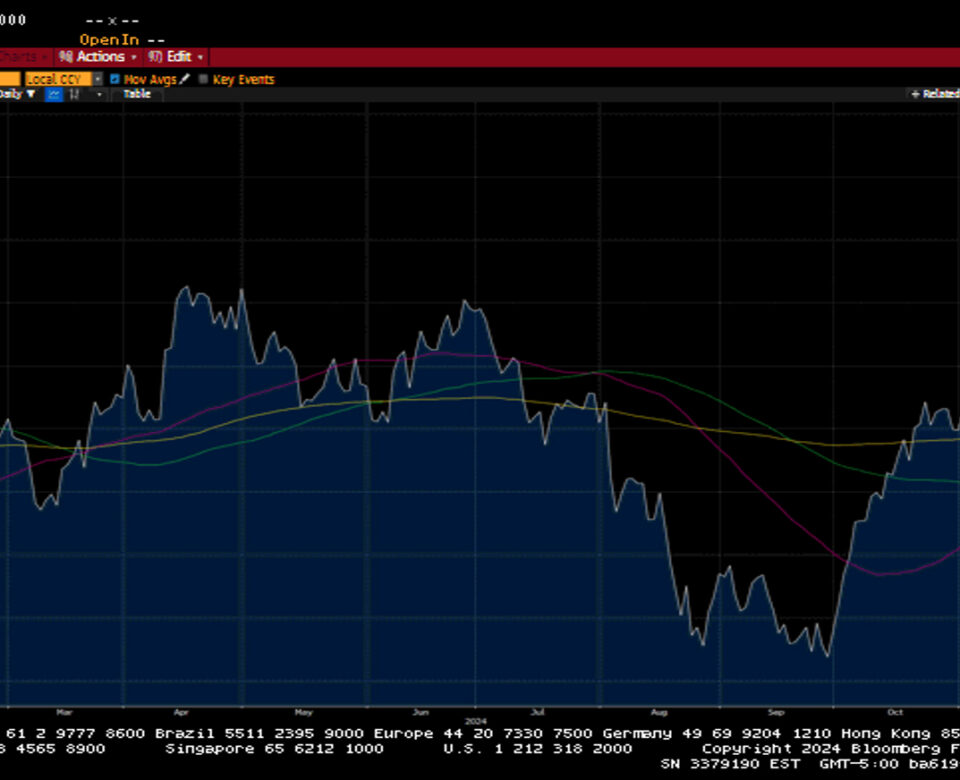

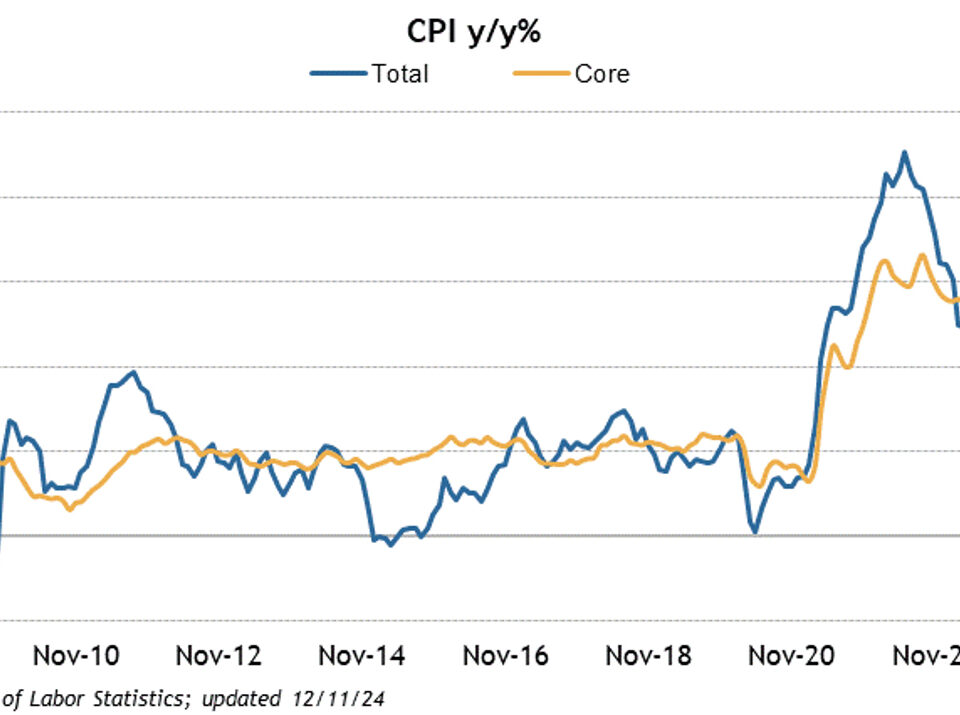

The S&P 500 gained 1.7%, the Dow rose 1.3%, the NASDAQ added 1.4%, and the Russell 2000 lagged, losing 0.8%. Trade in US Treasuries favored longer-tenured paper. The 2-year yield increased by seven basis points to 4.72%, while the 10-year yield fell by four basis points to 4.26%. Fed rhetoric for the week pushed back on a near-term rate cut and suggested cuts later in the year as inflation concerns persist. The probability of a rate hike in March and May is quite low, while a twenty-five basis point cut in June runs just under 70%.

West Texas Intermediate Crude prices fell 2.5% this week or $1.92 to 76.52 a barrel. The pullback in prices comes as negotiations for a cease-fire in Gaza take place in Paris. Gold prices increased by $24.10 to $2048.20 an Oz. Copper prices rose by $0.05 to $3.88 per Lb. Bitcoin was trading just above the $51,000 mark. The Dollar index fell by 0.3% to 103.94.

Economic news was fairly light this week but did show a continued tight labor market. Initial Jobless Claims came in down 12k to 201K as Continuing Claims fell by 63k to 1.826M. Existing Home sales continued to be soft but the January figure came in line with estimates of 4M units. Mortgage Applications fell by 10.6% as the 30-year mortgage rate eclipsed 7%. A preliminary look at the S&P Global Service PMI showed a decline in Services activity to 51.3 from 52.5. The FOMC minutes from the January meeting were consistent with what Fed Chairman Powell conveyed in his most meeting remarks.

Weekly Market Commentary – 12/30/24

Read more