Weekly Market Commentary 5/3/2024

May 3, 2024

Weekly Market Commentary – 5/17/24

May 17, 2024

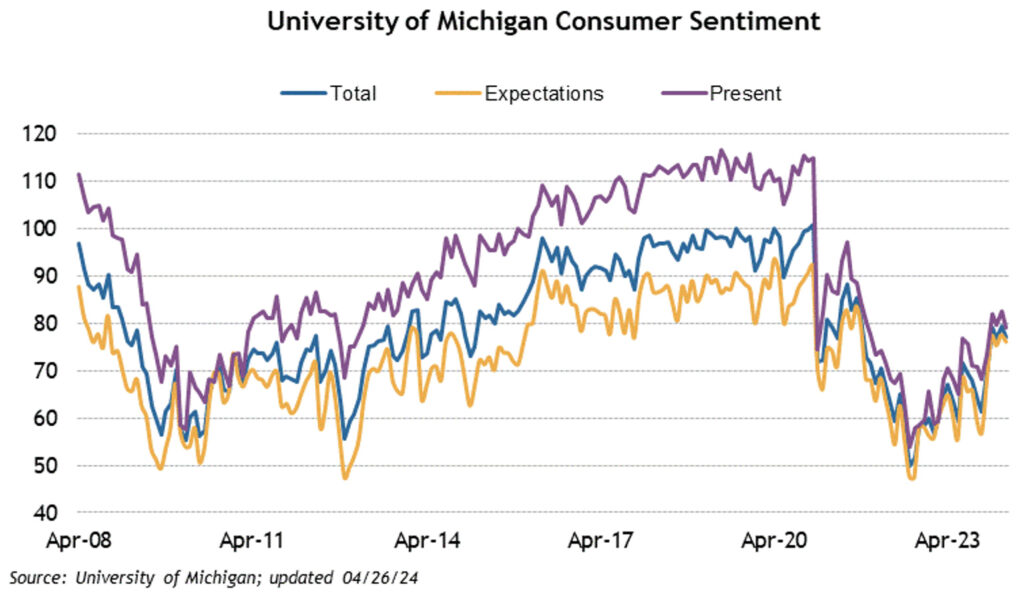

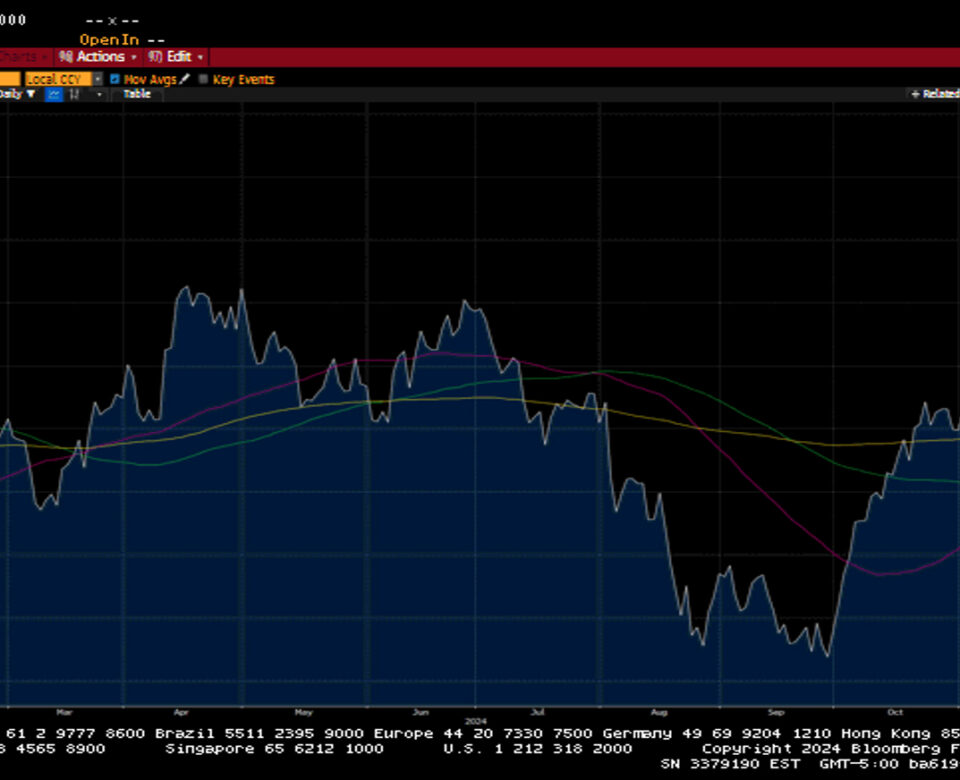

The S&P 500 notched a third consecutive week of gains as the index broke and held above its 50-day moving average. Investors were treated to another dose of first-quarter corporate earnings. Disney, Uber, and ARM results were disappointing, while Taiwan Semiconductor's monthly revenues beat expectations and sparked a rally in the Semiconductors. Over 80% of the S&P 500 companies have posted their quarter earnings, and earnings growth looks well above pre-earnings season estimates. Sector performance over the week was led by the Utilities, Financials, Materials, and Consumer Staples. This change in market leadership from technology to other sectors shows that the market rally is trying to broaden. This broadening out can also be seen with interest in European and Asia equities, where central bank policy will likely become more accommodative in the next couple of months. The Bank of England kept its policy rate in place but did indicate that it is poised to cut rates in the near future.

The S&P 500 gained 1.9%, the Dow rose by 2.2%, the NASDAQ added 1.1%, and the Russell 2000 increased by 1.2%. US Treasuries lost some ground this week, but trade seemed fairly quiet relative to the last several weeks. Interestingly, this relatively quiet market came as the Treasury auctioned $125 billion in Treasuries. The auction results were mixed, with the 3-year and 10-year auctions getting tepid interest, while the 30-year saw decent interest. The 2-year yield increased by six basis points to 4.87%, while the 10-year yield was unchanged on the week at 4.50%. Oil prices were little changed for the week closing at $78.20 a barrel. Gold prices increased by 2.8% to close at $2374.80 an Oz. Copper prices bounced back this week, gaining $0.11 to $4.66 per Lb. The US Dollar index increased by 0.2% to 105.3.

The S&P 500 gained 1.9%, the Dow rose by 2.2%, the NASDAQ added 1.1%, and the Russell 2000 increased by 1.2%. US Treasuries lost some ground this week, but trade seemed fairly quiet relative to the last several weeks. Interestingly, this relatively quiet market came as the Treasury auctioned $125 billion in Treasuries. The auction results were mixed, with the 3-year and 10-year auctions getting tepid interest, while the 30-year saw decent interest. The 2-year yield increased by six basis points to 4.87%, while the 10-year yield was unchanged on the week at 4.50%. Oil prices were little changed for the week closing at $78.20 a barrel. Gold prices increased by 2.8% to close at $2374.80 an Oz. Copper prices bounced back this week, gaining $0.11 to $4.66 per Lb. The US Dollar index increased by 0.2% to 105.3.

Weekly Market Commentary – 12/30/24

Read more