Weekly Market Commentary – 7/5/24

July 5, 2024

Weekly Market Commentary – 7/19/24

July 19, 2024

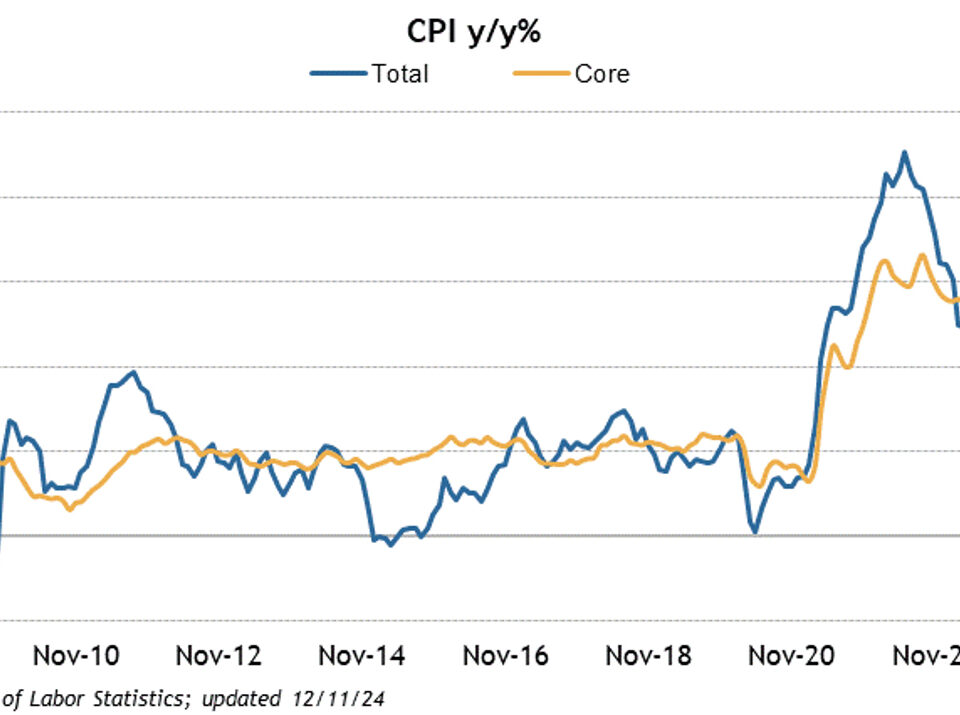

US financial markets were able to log another set of all-time highs as investors cheered a weaker-than-anticipated Consumer Price Index report that signaled more progress on the inflation front. The US Treasury market rallied nicely on the news and sent a bid into parts of the market that have lagged over the year's first six months of 2024. Mega Cap stocks took a back seat as the equal-weighted S&P 500 index outperformed alongside a massive upside move in small-caps.

The week started and progressed with more calls from congressional democrats and donors for President Biden to abandon his bid for another term. The President has pushed back on the calls and insists he will continue running for office. The uncertain political landscape increased on Saturday night in Pennsylvania when former President Trump was escorted from a rally after it sounded like gunshots were being fired. The current uncertain political landscape will likely increase market volatility.

Fed Chairman Powell was on Capitol Hill this week, but his testimony in front of the Senate Banking Committee and the House Financial Services Committee yielded very little new information.

The money center banks kicked off earnings season with better-than-expected results. However, with high expectations and decent gains already made in some of these names, investors sold shares after announcing the results. Pepsi announced disappointing results and offered tepid guidance on concerns over consumer spending.

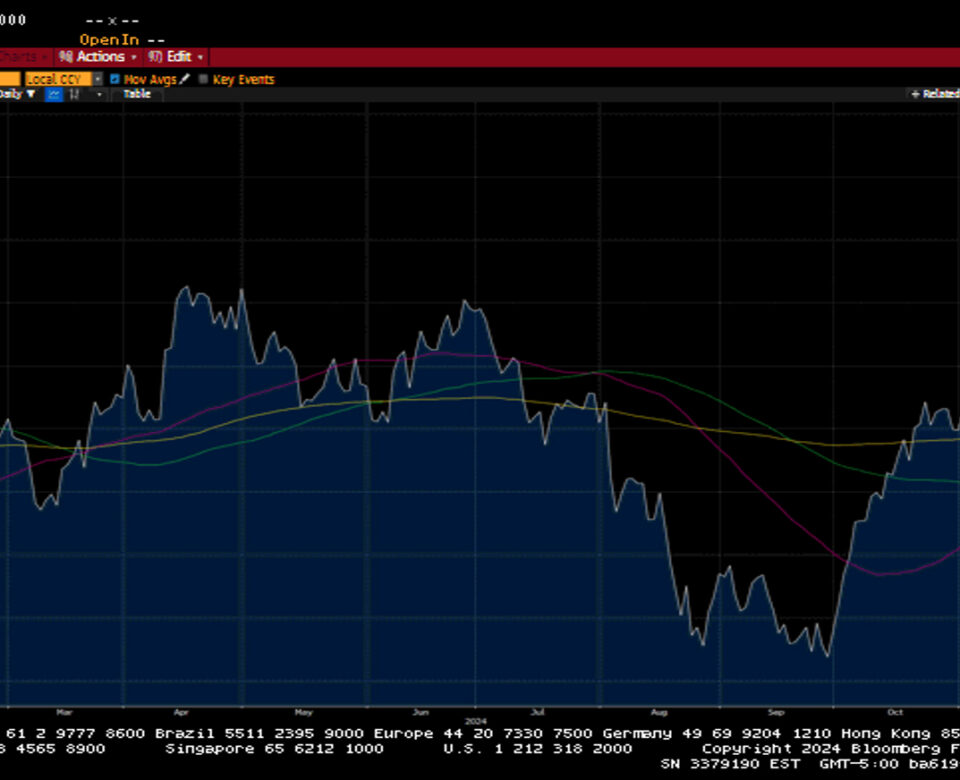

This week, the S&P 500 added 1%, the Dow increased by 1.6%, the NASDAQ lagged with a 0.3% advance, and the Russell 2000 rocketed 6% higher. US Treasuries gained ground that favored the short end of the yield curve. The 2-year yield decreased by fourteen basis points to 4.46%, while the 10-year yield fell by eight basis points to 4.23%. The lower move in yields came from a weaker-than-anticipated June CPI print that increased the likelihood of a September rate cut to nearly 94% and increased the chances of another rate cut in December.

Oil prices fell by 1.2%, or $1.04, to close at $82.19 a barrel despite further data showing larger-than-expected inventory drawdowns. Gold prices topped $2400, closing at $2420 an Oz. Copper prices increased by $0.06 to close at $5.493 per Lb. Bitcoin was able to bounce off its most recent lows and close just north of $57k a coin. Notably, the Bank of Japan finally intervened in the currency market, defending the Yen, and interestingly seemed to coordinate the move after the cooler-than-expected CPI print hit the tape. The $/Yen cross closed the week at 157.86. The US Dollar index fell by 0.8% to 104.44.

The economic calendar was again focused on inflation data scheduled to be released in the second half of the week. As mentioned, the CPI print came in cooler than expected on both the headline reading and the core reading, which excludes food and energy. Both data sets showed inflation moderating on a year-over-year basis, with the headline print showing an increase of 3% versus 3.3% in May, while the Core reading increased by 3.3% from 3.4% over the same time frame. Interestingly, the PPI, or Producers Price Index, came in hotter than expected, and the prior month's data were revised higher. The PPI came in at 0.2% versus 0.1%, while the Core reading increased by 0.4% versus 0.1%. On a year-over-year basis, PPI increased by 2.6% in June, up from 2.2% in May. The Core reading increased by 3% over the last year, up from 2.3% in May. The hotter-than-anticipated PPI prints hit the market after its release, but investors bought the dip on the increased expectations of a rate cut in September. Initial Jobless claims fell by 17k to 222k, while Continuing Claims fell by 4k to 1.852M.

Weekly Market Commentary – 12/30/24

Read more