Weekly Market Commentary – 7/26/24

July 26, 2024

Urgent Market Update – 8/5/24

August 5, 2024

Last week, markets took a significant step back on weaker-than-expected labor data that challenged the idea of an economic soft landing. Mega Cap technology earnings continued to show massive cap-ex spend on AI; however, enthusiasm about AI's benefits is now being put into context relative to its expense. Apple and Meta's results were met with buying, while Amazon and Microsoft’s results were met with selling pressure. A solid quarter by AMD induced a massive rally in the Semiconductor sector and saw NVidia’s market cap increase by $329 billion in a day, marking the largest single-day market cap gain for a company in history.

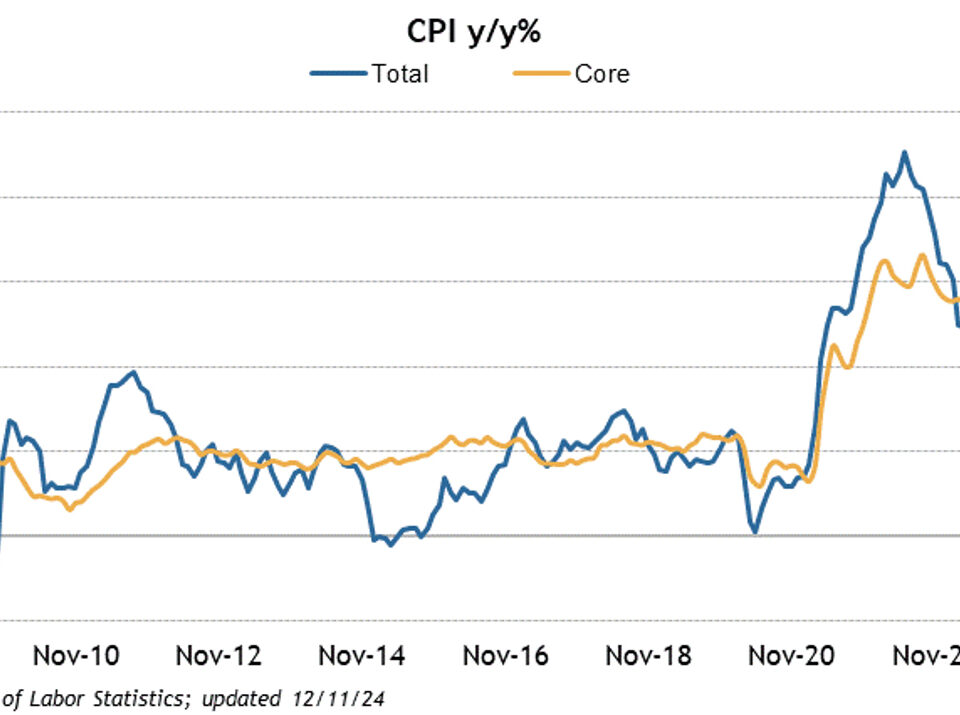

The Federal Reserve’s decision to leave its policy rate at 5.25%-5.50% was in line with expectations, as was Fed Chairman Powell’s post-meeting comments that telegraphed a September rate cut on the table. The Bank of Japan increased its policy rate by 0.15% and announced details on the end of its bond purchase program. The news was widely expected but further strengthened the move in the Yen, which has increased in value relative to the US dollar for the last five weeks in a row and hit the Japanese equity markets. The Bank of England, in a 5 to 4 decision, cut its rate by twenty-five basis points, again in line with market expectations.

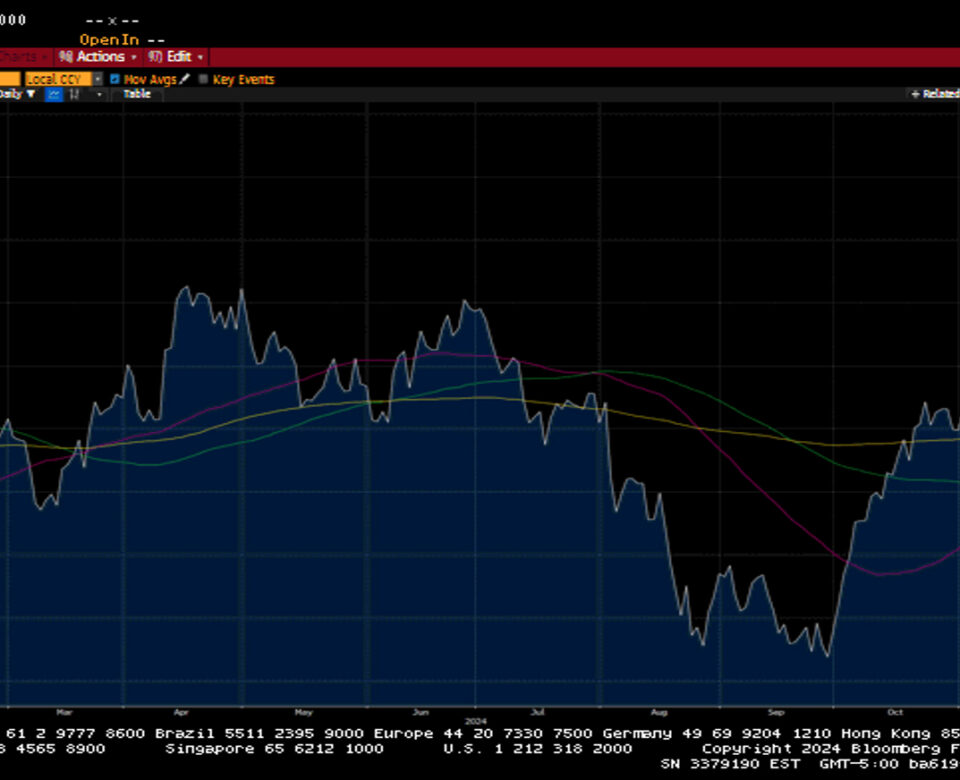

The S&P 500 and Dow fell by 2.1%, the NASDAQ declined by 2.4% (now is in a technical correction), and the Russell 2000 tumbled 6.7%. US Treasuries had an epic week, with yields plunging across the curve. The 2-year yield decreased by fifty-two basis points to 3.87%, while the 10-year yield fell by forty-one basis points to 3.79%. Oil prices continued to struggle even as tensions increased in the Middle East. It is expected that Iran will respond with an attack on Israel for the assassination of a Hamas leader that took place on Iranian soil. WTI prices closed down by 4.5% or -$3.46 to close at $73.67 a barrel. Gold prices topped $2500 an Oz before closing at $2469.80, up 3.7% for the week. Copper prices lost $0.01 to close at 4.10 per Lb. The Dollar Index shed 1% on the week and closed at 103.24.

The weaker-than-expected labor data and continued deterioration in US manufacturing catalyzed a massive rethink of the market’s narrative around an economic soft landing. ISM Manufacturing fell to 46.8 from 48.5, and every component under the headline figure appeared weak. Initial Jobless Claims increased by 14k to 249k, while Continuing Claims jumped by 33k to 1.877M. July’s Employment Situation Report showed a significant payroll slowdown and an unexpected tick-up in the Unemployment Rate. Non-farm payrolls increased by 114k versus an expected 170k, while Private Payrolls increased by 97k, well below the consensus estimate of 153k. The Unemployment rate rose to 4.3%, well above the expected 4.1%. Notably, the increase in the unemployment rate triggered the Sahm rule, which is an indicator of the start of a recession. Average Hourly earnings increased by 0.2%, lower than the anticipated 0.3%. The Average Workweek declined to 34.2 hours from 34.3. Given the weaker-than-expected labor data, there is now a 71% chance that the Fed will cut its policy rate by 50 basis points, and the market is now pricing in 100 basis points of cuts in 2024. Consumer Confidence rose to 100.3 versus an estimated 98. A preliminary look at Q2 Productivity came in much higher than expected at 2.3%, while at the same time, Unit Labor costs increased by 0.9%, less than the estimate of 2%

Weekly Market Commentary – 12/30/24

Read more