Urgent Market Update – 8/5/24

August 5, 2024

Weekly Market Commentary – 8/19/24

August 19, 2024

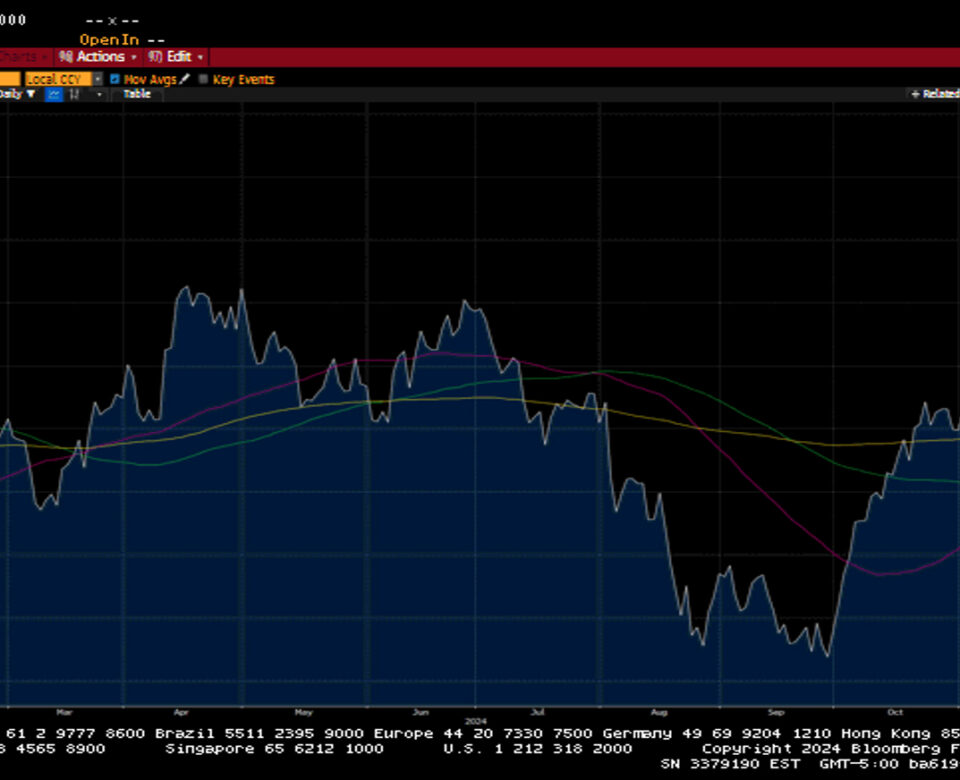

Wow, what a week for global financial markets. A rollercoaster ride for investors continued throughout the week as multiple narratives ricocheted off prior expectations. Crowded trades coupled with weaker-than-expected economic data in the prior week changed the market’s consensus outlook from an economic soft landing to a hard landing scenario in a heartbeat. Talk about an emergency rate cut by the Fed and a sizable increase in rate cuts expected into year-end were prevalent early in the week but subsided after stronger-than-expected Initial Jobless Claims seemed to calm market nerves. VIX, a measure of market volatility, spiked to 65, the largest jump since 1990. By the end of the week, it had traded back down to 20, a massive decline that we have not seen since 2010. Make no mistake about it—volatility will persist for the next several months.

The Japanese Nikkei 225 stock index fell the most over three sessions since 1959 on an unwinding of the popular carry trade. Increased interest rates in Japan, a stronger Yen, and the notion that the Federal Reserve would be cutting rates catalyzed the sell-off. Some market strategist suggest this trade had been 85% unwound.

Second-quarter earnings continued to roll in with notable winners and losers. Eli Lilly had a fantastic quarter as its weight loss drug gained market share from competitor Novo Nordisk. Palantir, Caterpillar, Uber, CF Industries, Akamai, and Expedia traded higher after their earnings announcements. Disney, Amgen, Airbnb, Intel, and Super Micro Computer fell on their earnings results.

The S&P 500 lost 0.6%, the Dow declined 0.7%, the NASDAQ fell 0.8%, and the Russell 2000 gave back 1.3%. US Treasuries gave up some of their outsized gains from the prior week. The 2-year yield increased by eighteen basis points to 4.05%, while the 10-year yield jumped fifteen basis points to 3.94%. Fed Fund's probabilities showed nearly a 95% chance of a fifty basis point cut by the Fed at the beginning of the week but fell to 49% Friday afternoon. Similarly, the street at the beginning of the week was looking for one hundred and fifty basis points of cuts into year-end but ended the week with just one hundred priced in. Oil prices increased off of their 7-month lows as increased tensions in the Middle East continued. West Texas Intermediate crude prices rose by $3.16 or 4.3% to close at $76.78 a barrel. Gold prices were little changed, gaining $3.90 to $2473.90 an Oz. Copper prices fell by a dime to $4.00 per Lb. Bitcoin closed the week little changed, but saw nearly a 20% drawdown before rebounding in the back half of the week. The US Dollar index fell by 0.1% to 103.24.

The economic calendar was relatively light this week but gave investors reason to believe the economy continues to be doing well. ISM Services came in better than expected at 51.4 and was well above the prior reading of 48.8. The data set showed a bounce back in business activity and employment. Initial Jobless Claims fell by 17k to 233k and came as a huge relief to the market that continues to be worried about the labor market. Continuing Claims increased by 6k to 1.875M. Notably, Intel, Cisco, Dell, and Paramount announced more layoffs this week, a trend we continue to watch.

Weekly Market Commentary – 12/30/24

Read more