Weekly Market Commentary – 10/21/24

October 21, 2024

Weekly Market Commentary – 11/04/24

November 4, 2024

Global markets pulled back last week as investors took the opportunity to reduce some risk before a very close US Presidential election. In the US, nearly 20% of the S&P 500 reported earnings. Generally, results came in better than expected; however, the market’s response was mixed. Tesla’s results were met by a 22% gain in the stock’s price as better margins, a strong outlook on deliveries, and the promise of a lower-priced Tesla model enthused market participants. Dow components IBM, HON, and GE results were met with selling pressure. Financials, Industrials, and Materials were laggards throughout the week. Mega-cap Technology issues flexed their market leadership as NVidia forged new all-time highs as investors await earnings from Google, Microsoft, Amazon, Apple, and Meta next week. These results and a much anticipated Employment Situation report on Friday will set the stage before the US election and the Federal Reserve’s November monetary policy decision.

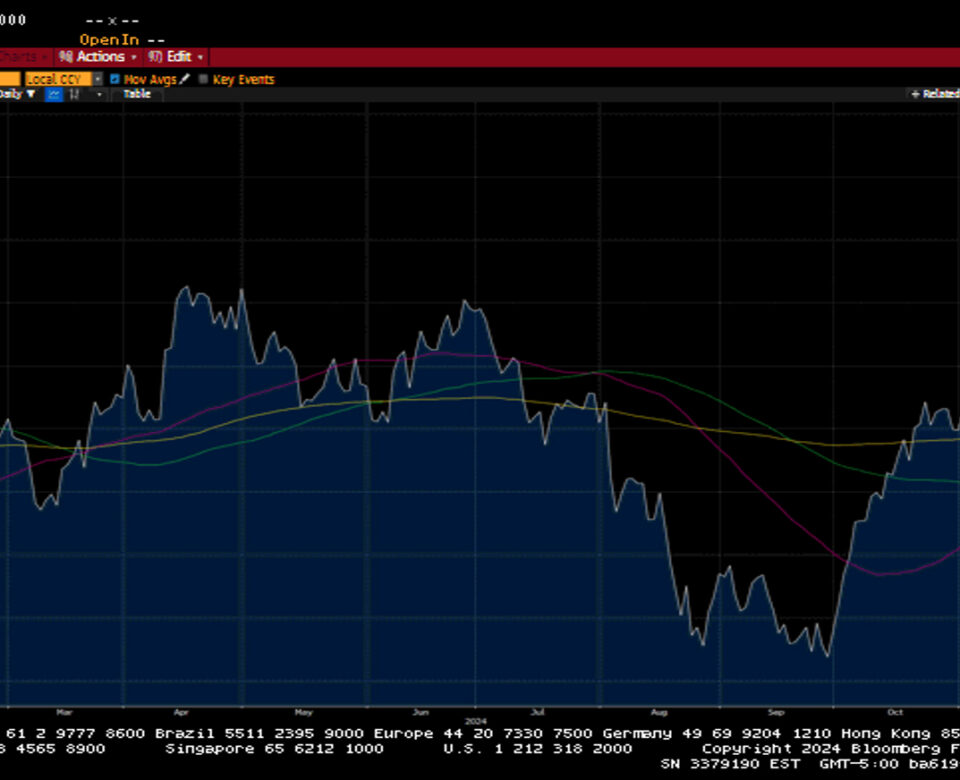

The S&P 500 shed 1%, the Dow lost 2.7%, the NASDAQ eked out a 0.2% gain, and the Russell 2000 fell by 3%. Notably, the NASDAQ was able to gain in a weak tape and is only 1% away from regaining its early July all-time highs. US Treasuries sold off across the curve in a volatile week of trade as expectations for further rate cuts were curtailed. The 2-year yield rose by fifteen basis points to 4.10%, while the 10-year yield increased by sixteen basis points to 4.23%. The significant increase in rates across the curve since the Federal Reserve decided to cut rates appears to have been dismissed by the equity markets; however, these increases in rates, alongside elevated market valuations, may have also provided reason for some profit-taking this week.

Oil prices increased by 3.7% to close at $71.77 a barrel, fueled by increased tensions in the Middle East and the announcement of more stimulus to the Chinese economy. On Saturday, Israel attacked Iranian military assets but avoided targeting energy infrastructure. The tempered response may pull the war premium out of oil and suggest lower prices for crude. The calibrated move is also seen as a chance for tensions to subside and for a restart of negotiations. Gold prices hit another record high before closing up $24.60 to $2754.80 an Oz. Copper prices fell by a penny to close at $4.37 per Lb. Bitcoin fell by $1,200 to 67,170. The US Dollar Index gained 0.8% to 104.27. The Japanese Yen hit a 3-month low relative to the US Dollar, and it is likely the Bank of Japan will intervene on any further weakness.

The economic calendar was quiet this week. A preliminary look at S&P Global Manufacturing and Services PMI showed progress on both manufacturing and services. Manufacturing came in at 47.8 versus the prior reading of 47.3, while Services ticked to 55.3 from the previous reading of 55.2. September New Home sales came in at 738k versus the consensus estimate of 713k. Existing home sales fell 1% to 3.84m as Mortgage Applications fell 6.7% from the prior week. Initial Claims fell by 15k to 227K, well below the street forecast of 246k. Continuing Claims increased by 28k to 1.897M. The final October reading of the University of Michigan’s Consumer Sentiment Index increased to 70.5 from the prior reading of 68.9. This was the third consecutive month of increasing sentiment with election uncertainly top of mind for consumers.

Weekly Market Commentary – 12/30/24

Read more