Weekly Market Commentary 3/22/2024

March 22, 2024

Weekly Market Commentary 4/5/2024

April 5, 2024

The S&P 500 hit another all-time high this week as investors appeared to rebalance positions into quarter end. The week started with some weakness on the announcement that the EU was investigating Meta, Google, and Apple on compliance concerns related to the Union’s Digital Market Act. The move coincided with the announcement that China would ban imports of chips made by AMD and Intel. That said, over March, there has been an evident broadening out of the market’s rally away from high-flying technology to other sectors such as Energy, Financials, and Industrials. The Magnificent Seven of 2023 morphed into the Fab Five as Tesla and Apple inked losses for the quarter. NVidia led gains in the group with an 87.59% advance. Consolidating the outsized moves seen over the last several months makes sense, and the broadening out of the rally is most likely a healthy indicator. Fed rhetoric this week skewed to the hawkish side as Atlanta’s Bostic called for only one rate cut this year, and Chris Waller suggested that he is not in any hurry to lower rates. Fed Chairman J Powell is scheduled to speak on Friday while global financial markets are closed for Good Friday.

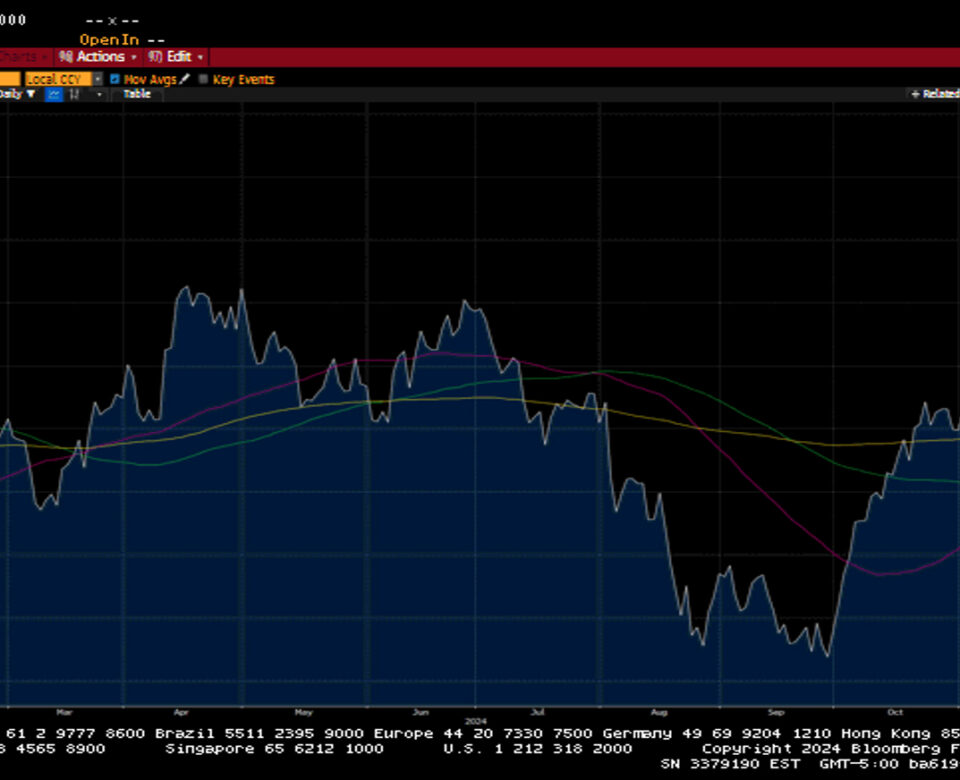

The S&P 500 gained 0.5%, ending March up 3.3% and is up 10.2% since the beginning of the year. The Dow Jones notched a 0.9% increase for the week, is up 2.1% for the month, and 5.6% higher from the start of the year. The NASDAQ lost some ground this week with a loss of 0.3% but was up 1.8% in March and 9.1% year to date. The Russell 2000, which has lagged much of the year, ended the week up 2.6%, the month up 3.4%, and is higher by 4.8% in 2024.

US Treasuries ended the quarter not too far from where they started in March but did gain ground across the curve. The 2-year yield declined by two basis points to close at 4.62%, while the 10-year yield fell by five basis points to 4.20%. The probability of the first rate cut in June is now 64%.

US Treasuries ended the quarter not too far from where they started in March but did gain ground across the curve. The 2-year yield declined by two basis points to close at 4.62%, while the 10-year yield fell by five basis points to 4.20%. The probability of the first rate cut in June is now 64%.

Oil prices continued to advance, increasing by $2.34 this week and by $4.72, or 6% for the month, to close at $82.99 a barrel. Gold prices increased by 9% or $185.30 to close at $2239.40 an Oz. Copper prices rallied 4.1% for the month on the announcement that China would curb smelting. The US dollar index gained 0.3% for the month, with outsized gains against the Japanese yen, while the Chinese Yuan was weaker against the US dollar.

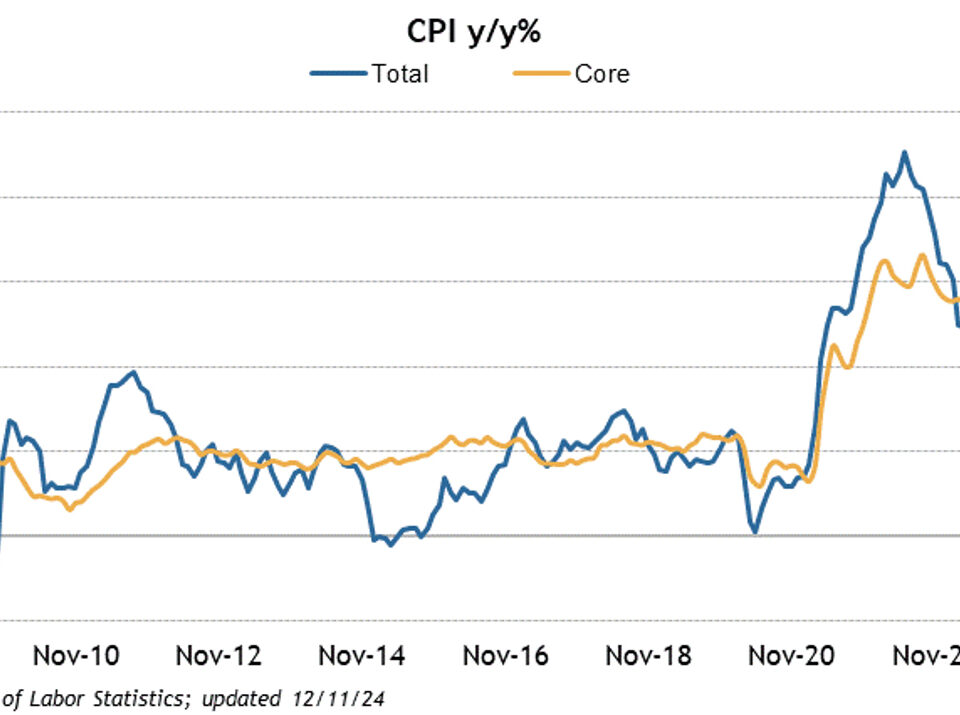

Friday's PCE print highlighted economic data for the week. The headline number was 0.3%, below the estimate of 0.4%. On a year-over-year basis, headline PCE increased in February to 2.5% from 2.4% in January. Core PCE, which excludes food and energy, came in as expected at 0.3% and grew at 2.8% annually, slightly lower than the 2.9% reading in January. Personal Spending for February was stronger than expected at 0.4%, while Personal Income came in a bit weaker than anticipated at 0.3%. Consumer confidence was weaker than expected, coming in at 104.7 versus the estimated 106.7. Interestingly, the final reading of the University of Michigan’s consumer sentiment increased to 79.4 versus the February reading of 76.9, predicated on lower inflation expectations. The third look at 4thquarter GDP ticked to 3.4% from 3.2% while the GDP deflator stayed at 1.6%. Initial Claims decreased by 2k this week to 210k, while Continuing Claims increased by 24k to 1.819M.

Weekly Market Commentary – 12/30/24

Read more