Weekly Market Commentary – 2/2/2024

February 2, 2024

Weekly Market Commentary – 2/16/2024

February 16, 2024

The S&P 500 hit another record high and topped the 5000 level for the first time as investors focused on better-than-expected Q4 earnings. The economic calendar was light this week but showed continued strength in the economy. That strength gave reason to sell US Treasuries and further recalibrate the timeline for the Federal Reserve to start cutting rates. Interestingly, the sell-off in Treasuries coincided with solid 3, 10, and 30-year auctions this week.

Fourth-quarter earnings continued to roll in this week with a skew to better-than-expected results. Outsized moves in ARM holdings, Palantir, and Cloudflare propelled shares across the technology spectrum, especially the semiconductor sector. This week, Eli Lilly, CVS, DuPont, Chipotle Mexican Grill, Ford, Caterpillar, and Disney were winners. Amgen, Pepsi, PayPal, and McDonalds had disappointing results.

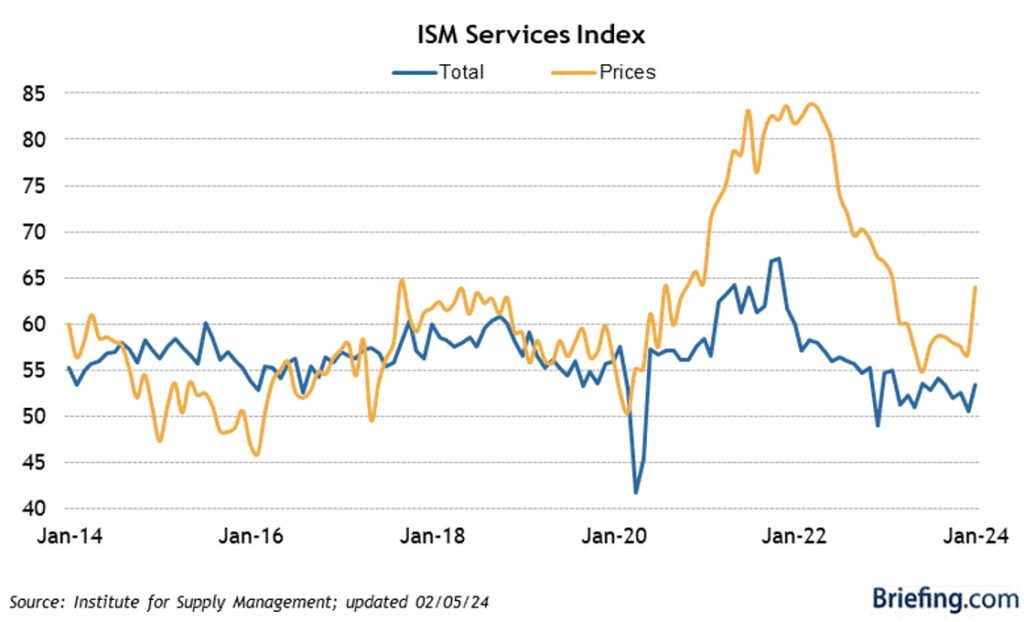

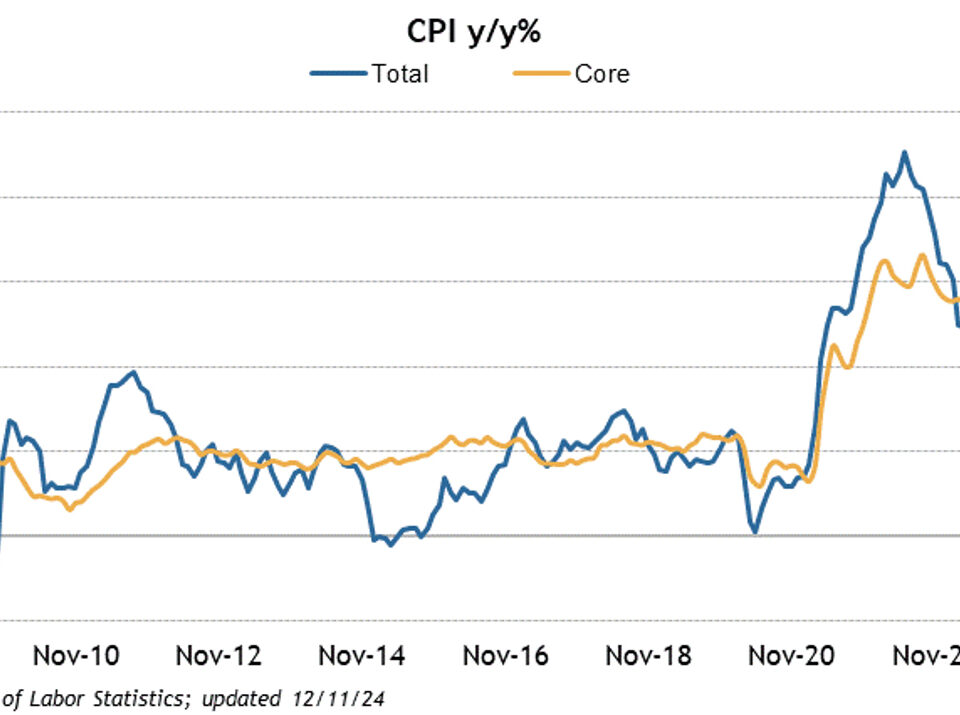

ISM Services headlined the economic data this week. The report showed an acceleration in the services sector, constituting about 75% of the US economy. January Services increased to 53.4 versus the street consensus of 51.7 and increased from 50.5 in December. Initial Jobless Claims fell by 9k to 218k, while Continuing Claims fell by 23k to 1871k. The Bureau of Labor Statistics also released their seasonally adjusted revisions for the Consumer Price Index which showed a slight downtick on the December headline reading to 0.2% from 0.3%.

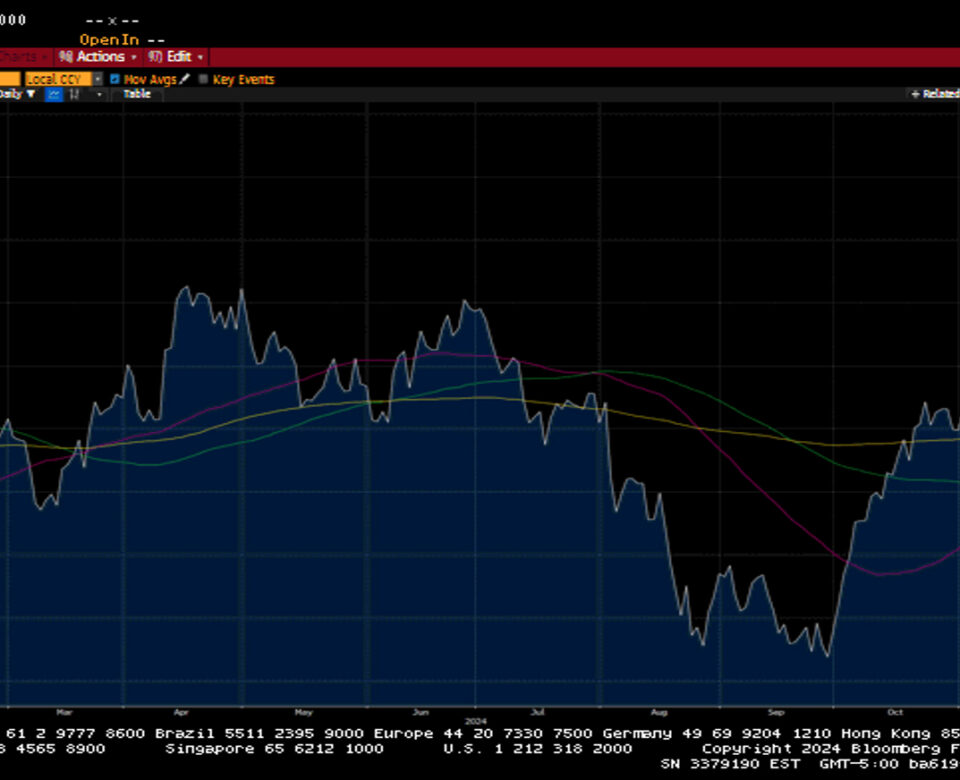

The S&P 500 gained 1.4%, the Dow was flat, the NASDAQ increased by 2.3%, and the Russell 2000 led with a gain of 2.4%.

Despite decent demand for US Treasuries in 3 auctions this week, US Treasuries sold off across the curve. Hawkish comments from Powell and other Fed officials echoed the need for more evidence that inflation is moving toward their 2% mandate. The 2-year yield increased by twelve basis points to 4.50% while the 10-year yield increased by sixteen basis points to close at 4.19%. The higher move in yields decreased the probability of a May rate cut from just over 73% a week ago to 60.7%.

Oil prices surged 6.3% or $4.50 to $76.82. Middle East tensions continued as Israel’s Prime Minister, Benjamin Netanyahu, dismissed a plan for a prolonged cease-fire in Gaza. Tensions were also catalyzed by a US strike on Iranian proxies in Iraq that reportedly killed the militia leader behind the attacks that killed three American soldiers in Jordan last month. Gold prices fell by $15.30 to close at $2038.30 an Oz. Copper prices fell by $0.14 to $3.68 per Lb. Of note, Bitcoin eclipsed the 47k level for the first time since the SEC approved several spot Bitcoin ETFs. The US Dollar Index increased by 0.2% this week to close at 104.11.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

Weekly Market Commentary – 12/30/24

Read more