The Week In Review: January 14th – January 20th

January 22, 2024

The Week In Review: January 28th – February 3rd

February 6, 2024

US equities inked another set of weekly gains on the back of mixed 4th quarter earnings results and encouraging economic data. The S&P 500 and Dow set new all-time highs. Dutch Semiconductor Company ASML reported solid results. Netflix, Verizon, United Airlines, American Express, and IBM also posted better-than-expected results and traded higher after their earnings announcements. Conversely, Tesla, Intel, Texas Instruments, DuPont, Kimberly Clarke, AT&T, and Johnson and Johnson reported disappointing results and sold off after their announcements. Monetary policy decisions from the European Central Bank and the Bank of Japan were as expected, with no changes to policy rates with bankers signaling movement in policy in the coming months. Donald Trump won the New Hampshire primary, but Nikki Haley decided to remain in the Presidential race despite the victory.

The S&P 500 increased by 1.1%, the Dow rose 0.6%, the NASDAQ added 0.9%, and the Russell 2000 advanced 1.7%. Action across the yield curve was mixed. The front end of the curve was slightly bid while longer-tenured Treasuries were sold. The 2-year yield declined five basis points to 4.36%. The 10-year yield increased by one basis point to 4.16%. Oil prices rallied by 6.2% or $4.60, with WTI closing at $78.04 a barrel. The strong move came after China announced additional stimulus measures with reduced bank reserve requirements that could increase economic activity and oil demand. Gold prices declined $12.20 to close at $2017 an Oz. Copper prices increased by $0.06 to $3.85 per pound. The US Dollar index gained 0.2% to close at 103.43.

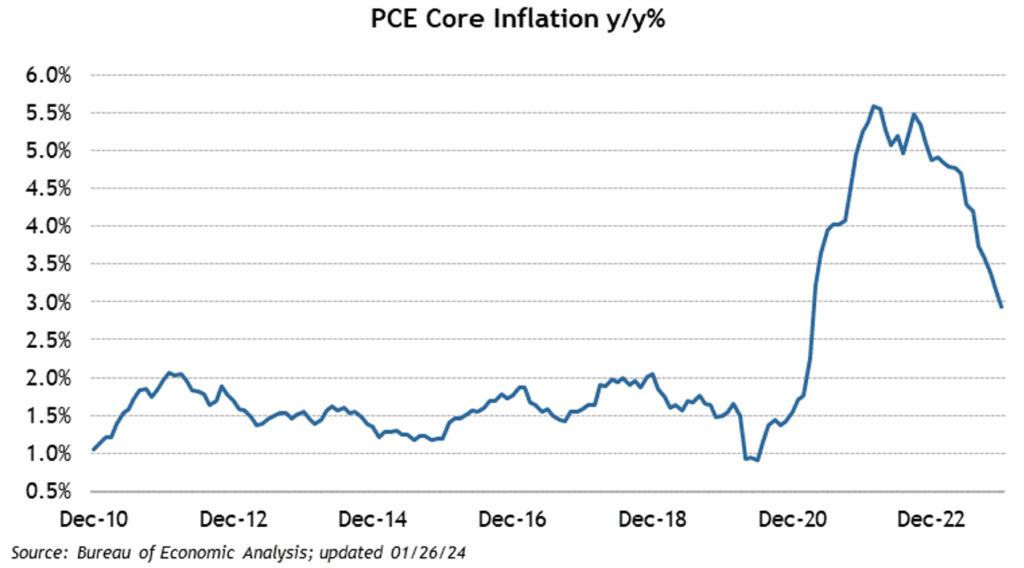

A preliminary read on 4th quarter GDP was much more robust than expected coming in at 3.3% versus an estimated 2% growth rate. The GDP Price Deflator also showed a more significant decrease in inflation at 1.5% vs. the expected 2.8%. Headline PCE and Core PCE came in as expected at up 0.2% month over month, but on a year-over-year basis, the headline number was flat at 2.6% while the Core reading fell from 3.1% in November to 2.9% in December. Personal Spending showed a resilient consumer that spent 0.7% in December versus the expectation of 0.4% figure. Personal Income came in as expected at 0.3%. The S&P Global US Manufacturing and Services PMIs showed expansion for both sides of the economy. Initial Unemployment claims ticked higher by 25k to 214k, while Continuing Claims increased by 27k to 1833k.

Weekly Market Commentary 4/5/2024

Read more