Weekly Market Commentary – 10/07/24

October 7, 2024

Weekly Market Commentary – 10/21/24

October 21, 2024

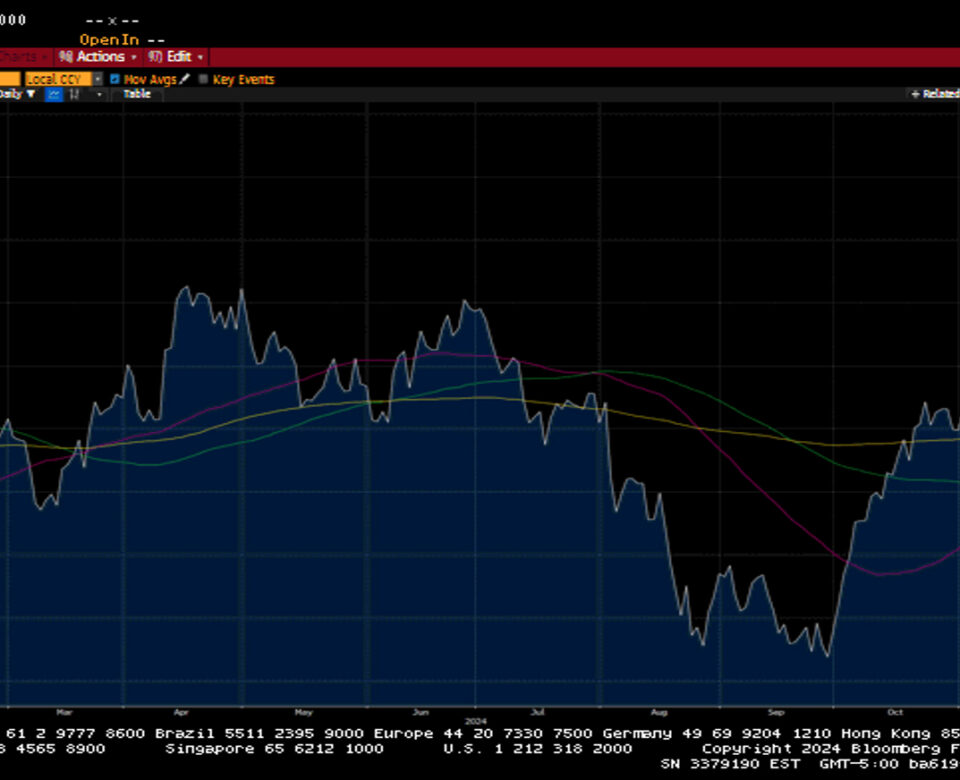

The S&P 500 and Dow Jones Industrial Average forged another set of all-time highs despite facing several macro headwinds. Chinese markets reopened after celebrating Golden Week with significant losses. Investors were expecting an announcement with more significant stimulus initiatives. Still, the initial stimulus amount fell short of market expectations and hit shares on Hong Kong’s Hang Seng (-6.5 %) and the Chinese Shanghai Composite (-3.6%). Investors also had to contend with Hurricane Milton devastating parts of Florida after Helene’s horrific destruction across the southeast. The fallout from these storms will profoundly affect regional economies, influencing economic data sets for several months. Our prayers and thoughts go out to those affected by the hurricanes. Investors were also focused on the direction of monetary policy. Expectations of further rate cuts have been tempered after the stronger-than-anticipated September Employment Situation Report.

The minutes from last month's Federal Reserve’s Open Market committee meeting yielded very little incremental information but indicated some pushback on cutting by fifty basis points. Inflation data reported this week came in a bit hotter than expected, strengthening the argument for less aggressive policy easing. There was plenty of corporate news to digest as the third-quarter earnings season kicked off. The financials led markets higher on Friday after JP Morgan, Wells Fargo, and Blackrock earnings were cheered by Wall Street. Other notable corporate news included the Department of Justice’s intentions to break up Alphabet (Google), Wells Fargo’s downgrade of Amazon due to worries about future margin compression, and Tesla’s disappointing/underwhelming Robo-Taxi launch event.

The S&P 500 gained 1.1% as Goldman’s CIO Kosten and Morgan Stanley’s Market Strategist, Mike Wilson, increased their 12-month S&P 500 forecasts higher. The Dow advanced by 1.2%, the NASDAQ added 1.1%, and the Russell 2000 increased by 1%. The yield curve continued to steepen, with shorter-tenured Treasuries outperforming their longer-duration counterparts. The 2-year yield increased by one basis point to close at 3.94%, while the 10-year yield rose by nine basis points to 4.07%.

Oil prices extended recent gains on continued tensions in the Middle East. An Israeli attack on Iranian energy infrastructure is likely and was considered eminent last week after Israel’s defense secretary canceled a scheduled trip to Washington. West Texas Intermediate crude prices increased by $1.06 or 1.4% to $75.46 a barrel. Gold prices increased by $6.90 to $2675.80 an Oz. Copper prices fell by $0.08 to $4.40 per Lb. Bitcoin gained ~ $1000 to close at $62,916. The US Dollar index advanced by 0.4% to 102.86, with a noticeable weakness in the Japanese Yen, which closed at 149.09.

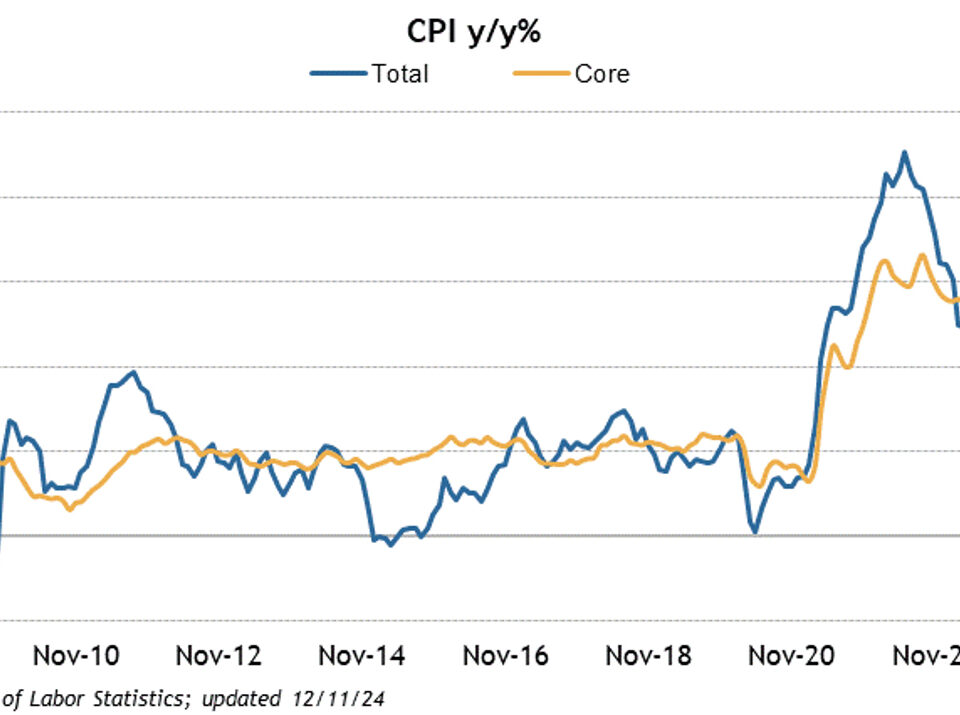

The Economic calendar featured two measures of inflation. Headline CPI increased by 0.2%, above the consensus estimate of 0.1%. Core CPI, which excludes food and energy, increased by 0.3% versus the forecast of 0.2%. On a year-over-year basis, headline CPI increased by 2.4%, while Core CPI advanced by 3.3%. Interestingly, the shelter component of the data series showed declines, something we have not seen for quite some time. The producer Price Index (PPI) was flat versus an anticipated increase of 0.1%. Core PPI increased by 0.2%, in line with the consensus estimate. On a year-over-year basis, the headline PPI increased by 1.8% while the Core figure advanced by 2.8%. Initial Jobless Claims surprised to the upside with an increase of 33k to 258k, while Continuing Claims rose by 42k to 1861k. Some of the uptick in Initial Claims may be related to Hurricane Helene. A preliminary look at the University of Michigan’s Consumer Sentiment fell to 68.9 from 70.1 due to continued frustration with elevated prices.

Weekly Market Commentary – 12/30/24

Read more