Weekly Market Commentary – 10/28/24

October 28, 2024

Weekly Market Commentary – 11/11/24

November 11, 2024

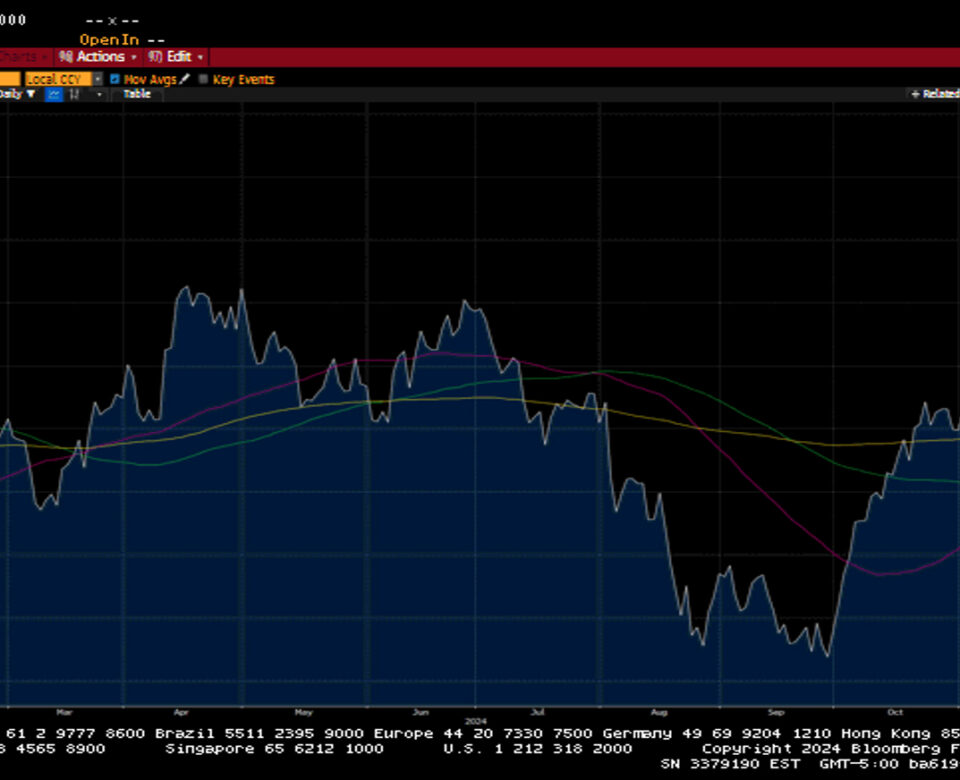

It was a very busy week on Wall Street as investors analyzed a deluge of corporate earnings reports and a full economic data calendar. The S&P 500 traded lower for the second consecutive week and could not close out October with a gain, having gained ground in the prior six consecutive months. Mega-cap earnings results were mixed, with results from Google and Amazon cheered, while results from Apple, Microsoft, and Meta were booed. A common theme in these names is increased capital expenditures on AI, and management teams continued to convey that the elevated spending would continue. Questions regarding when investors would see a return on investment resurfaced and put further question marks around the mega-cap issue’s valuations. The semiconductor sector came under some pressure this week, catalyzed by poor results from AMD and the announcement that Ernst and Young had resigned as Super Micro Computer’s accountant. AMD fell 11.29% while Super Micro cratered 45.41%. Other notable earnings came from Eli Lilly, which missed its quarterly estimates and telegraphed a weaker forecast. Intel missed estimates, but the guidance encouraged investors. Chevron and Exxon Mobile posted solid results.

The S&P 500 lost 1.4%, the Dow gave back 0.2%, the NASDAQ slid 1.5%, and the Russell 2000 posted a gain of 0.1%. The US Treasury market continued to struggle as yields across the curve increased. The 2-year yield increased by ten basis points to 4.20%, while the 10-year yield jumped by thirteen basis points to 4.36%. Much of the narrative around the increase in yields over the last month has been related to the idea that there will be no fiscal austerity in Washington with either presidential candidate. The market continues to price in a twenty-five basis point cut by the Fed this coming Thursday.

Oil prices fell early in the week as a war premium was taken off but rallied late in the week on news that Iran is planning fresh attacks on Israel. WIT was off $2.25 or 3.1%, closing at $69.52 a barrel. Gold prices fell by $5.30 to $2,749.50 an Oz. Copper prices were unchanged on the week, closing at $4.37 per Lb.

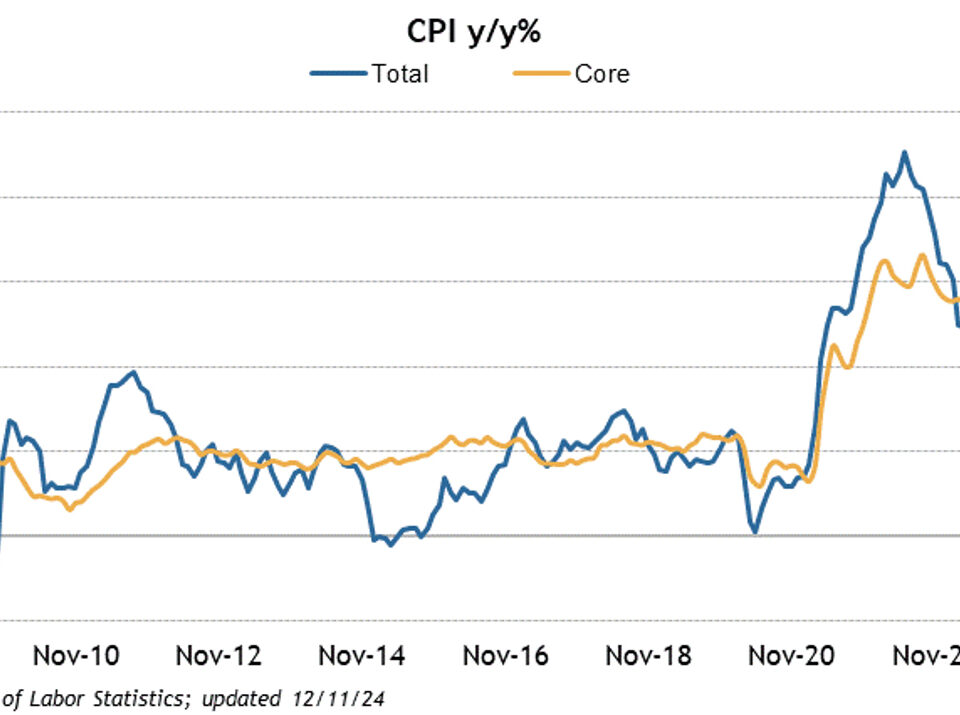

This week, the economic data calendar was stacked, with investors focused on the PCE print and the Employment Situation Report. Headline PCE increased by 0.2%, in line with expectations. On a year-over-year basis, the figure increased by 2.1%, down from 2.3% in August. Core PCE, which excludes food and energy, rose by 0.3%, slightly above the expected 0.2%, and was up 2.7% over the last year, unchanged from the prior two months. The Employment Situation report was viewed with some reservations, given the impact expected from hurricanes Helene and Milton. The report showed that non-farm payrolls increased by just 12k, well below the estimated 125k. Private Payrolls fell by 28k versus the estimated 115k. The Unemployment rate came in at 4.1%, unchanged from September. Average Hourly earnings increased by 0.4%, slightly higher than the expected 0.3%. The Average work week came in at 34.3 hours versus the expected 34.2 hours. These two reports gave the green light for the Fed to cut rates in their upcoming meeting. Initial Claims fell by 12k to 216k, while Continuing claims fell by 26k to 1862k. Personal Income increased by 0.3% and Personal Spending increased by 0.5%. Consumer Confidence showed a nice uptick to 108.7; the street was looking for a print of 99.3. ISM Manufacturing showed an acceleration in contraction with a below-consensus reading of 46.5%.

Weekly Market Commentary – 12/30/24

Read more