Weekly Market Commentary – 11/11/24

November 11, 2024

Weekly Market Commentary – 11/25/24

November 25, 2024

US equity markets pulled back last week as investors took profits from the outsized move higher seen following the US election. Sticky inflation prints, coupled with solid retail sales and hawkish comments from Federal Reserve Chairman J. Powell, sent interest rates higher, giving investors another reason to sell the market. Powell said, “The economy is not sending any signals that we need to be in a hurry to cut rates.” The probability of a twenty-five basis point rate cut at the Fed’s December meeting fell from nearly 80% to 55% off his comments. President-elect Trump’s announcements of some controversial anti-establishment cabinet nominees also influenced the markets. For instance, his pick to head the Department of Health and Human Resources, Robert Kennedy Jr- a vaccine skeptic, catalyzed a sell-off in the healthcare sector, which fell by 5.5% in the week.

World leaders continued to vet Trump 2.0 on tariff implications, economics, and the military conflicts in the Middle East and Ukraine. China’s President met with President Biden in Peru on Saturday and stated, “China is ready to work with the new US administration to maintain communication, expand cooperation and manage differences, so as to strive for a steady transition of the China-US relations for the benefit of the two peoples. No doubt there is more to come on how the new administration's agenda will play out and how it will influence Wall Street.

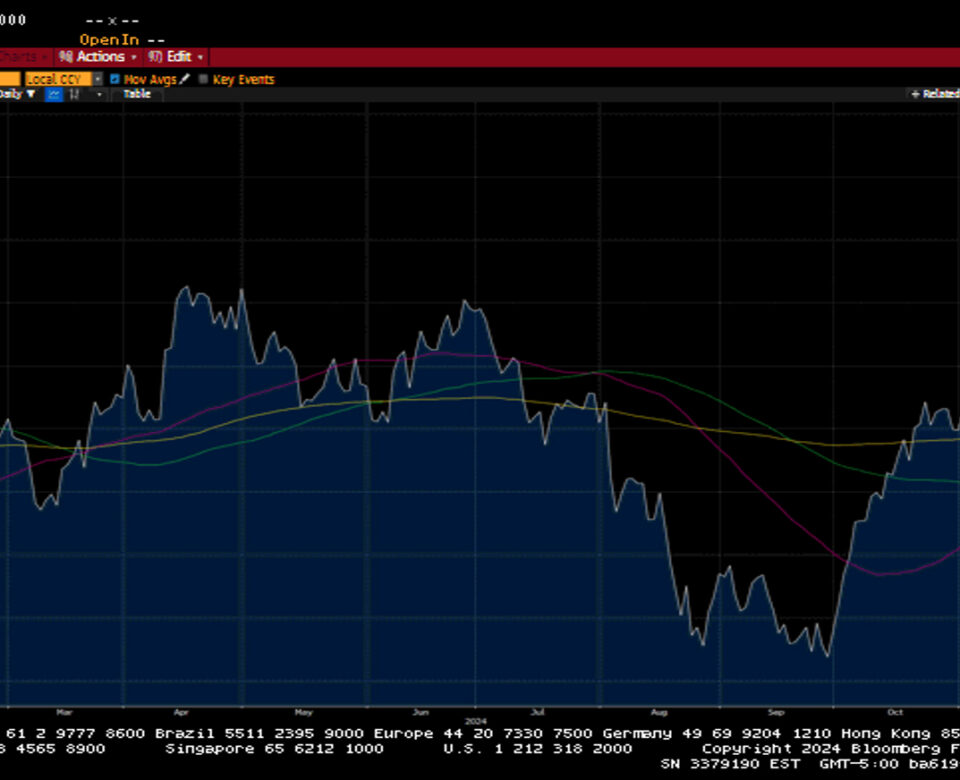

The S&P 500 fell 2.1%, the Dow was off by 1.2%, the NASDAQ declined by 3.1%, and the Russell 2000 slumped by 4%. US Treasuries continued to sell off, with longer-tenured paper taking the brunt of the move. The US 2-year yield increased by five basis points to 4.30%, while the US 10-year yield increased by twelve basis points to 4.43%. The 10-year yield hit 4.5% during Friday’s session, the highest level since May 31st. Higher US yields continued to strengthen the US Dollar, which hit a 2-year high. The US Dollar index rose by 1.6% to close at 106.67. The stronger dollar continued to impact the commodity complex. Generally, as the US Dollar appreciates, it becomes a headwind for commodity prices. Oil prices tumbled by $3.36 or 4.8% to close at $67.02 a barrel. Gold prices fell $123.70 or 4.5% to $2,570 an Oz. Copper lost 5.5%, closing at $4.07 per Lb. Bitcoin topped $93,000 before settling up 20% on the week at $91,188.

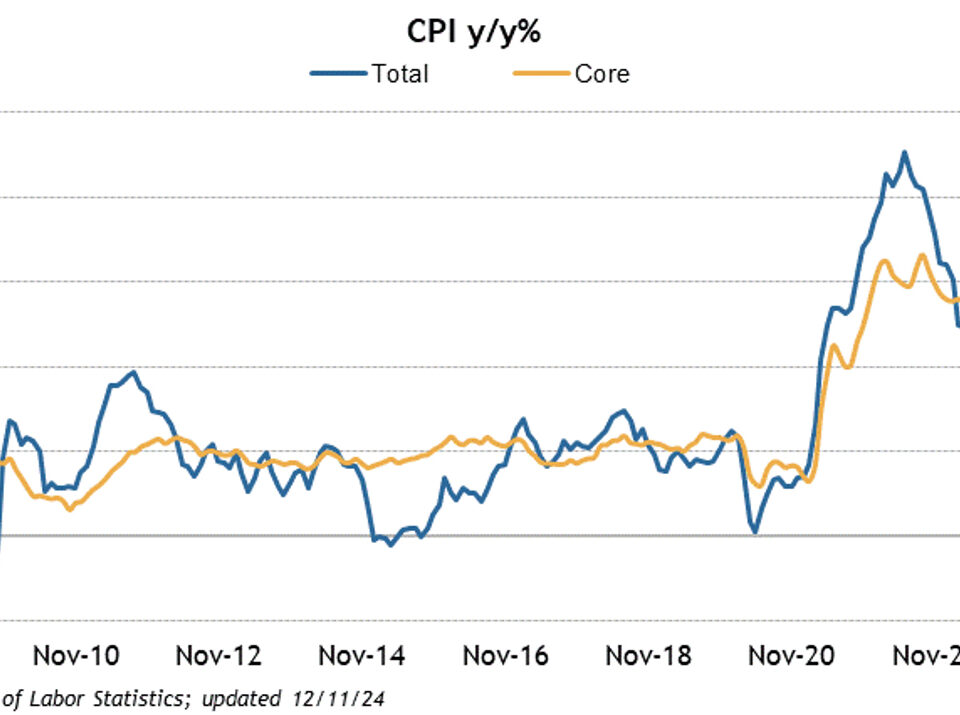

The economic calendar featured a look at October consumer and producer inflation data. The headline Consumer Price Index increased by 0.2%, in line with the street consensus estimate. The reading was up 2.6% on a year-over-year basis, up from the 2.4% print in September. Core CPI, which excludes food and energy, also came in line with expectations at 0.3% and was up 3.3% year-over-year, the same level seen in September. Headlined and Core October PPI came in as expected at 0.3%. However, both year-over-year readings in October, 2.4% and 3.1%-respectively, were higher than the previous September readings. October Retail sales were better than expected, coming in at 0.4% versus the consensus estimate of 0.2%. There was also a notable revision higher to the September retail figures. The consumer continues to be resilient, which provides a healthy backdrop for corporate profits. With 3rd quarter earnings nearly completed, the S&P 500 saw an 8.4% increase in profits- roughly double what was expected. Initial Claims fell by 4k to 217k, while Continuing Claims declined by 11k to 1873k.

Weekly Market Commentary – 12/30/24

Read more