Weekly Market Commentary – 11/18/24

November 18, 2024

Weekly Market Commentary – 12/2/24

December 2, 2024

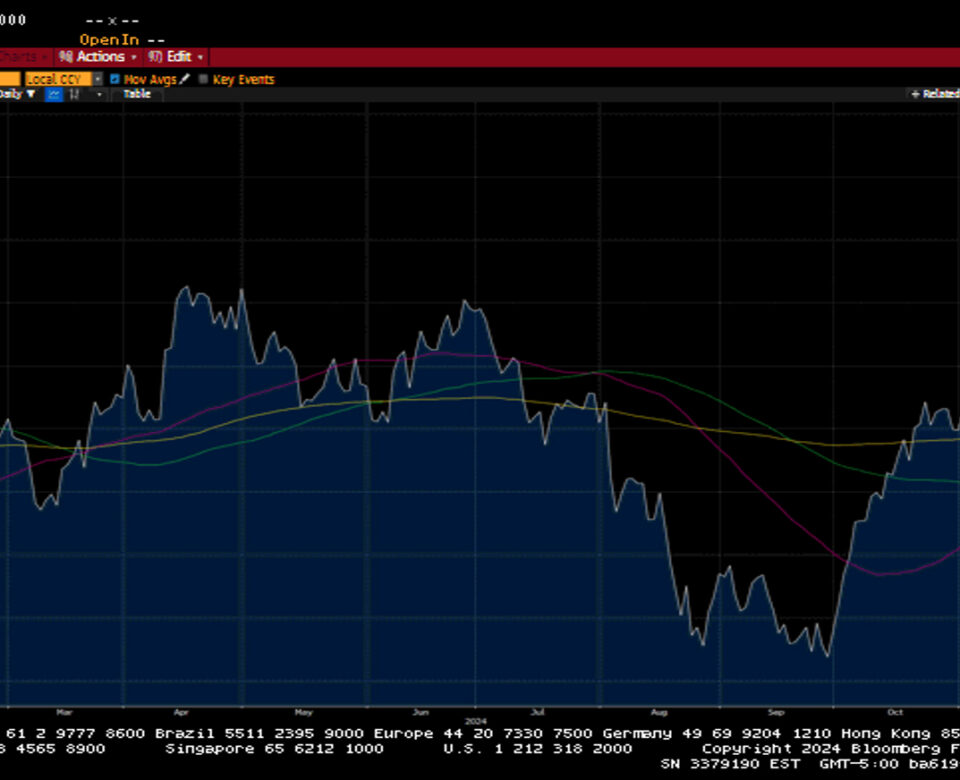

Markets bounced back as investors reengaged the pro-growth Trump 2.0 trade. President-elect Trump continued to fill out his cabinet and, late Friday announced Scott Bessent as his nominee for Treasury Secretary. Wall Street has endorsed Bessent, who is seen as a fiscal hawk who will support Trump’s tariffs and trade policies. Matt Gaetz removed himself as the nominee for Attorney General amid allegations of sexual misconduct, which prompted Trump to nominate Pam Bondi for the position. Current SEC Chairman Gary Gensler announced he would step down in January, which led to more discussions on deregulation, with much attention placed on the Cryptocurrency markets. Notably, Bitcoin approached $100k in Friday’s session.

An escalation of tensions in the Russia-Ukraine war sent investors to safe-haven assets such as gold, the US Dollar, and US Treasuries. The use of US and British-made missiles by Ukraine on Russian assets prompted the Kremlin to update its nuclear doctrine and to use an intercontinental ballistic missile in a subsequent attack on Ukraine.

All eyes were on NVidia and its third-quarter earnings results. The company did not disappoint, posting better-than-expected results and raising guidance for the coming quarter. The stock ended the week flat, which is kind of crazy, given the market expectations for a sizeable move in either direction post-earnings. Other notable earnings included solid results from Walmart, Ross, and Snowflake. Target’s results were a disaster, sending shares lower by more than 20%.

The S&P 500 gained 1.2%, the Dow jumped 2%, the NASDAQ advanced 1.7%, and the Russell 2000 increased by 4.5%. Despite an early week's bid into Treasuries, the yield curve saw selling at the front end of the curve. The 2-year yield increased by seven basis points to 4.37%, while the 10-year yield fell by two basis points to 4.41%. The 2-10 spread compressed to just four basis points.

Oil prices advanced by 6.3% or $4.26 to close at $71.28 a barrel. Gold prices increased by 5.5% to $2713.10, the largest weekly move since May 2023. Copper prices rose by $0.02 to $4.09 per Lb. Bitcoin rose by $6300 to $97,455, falling just short of 100k on Friday. The US Dollar index rose for the eighth consecutive week, gaining 0.8% and closing at 107.55. The Euro fell to 1.0410, while the Japanese Yen closed the week just under 155.

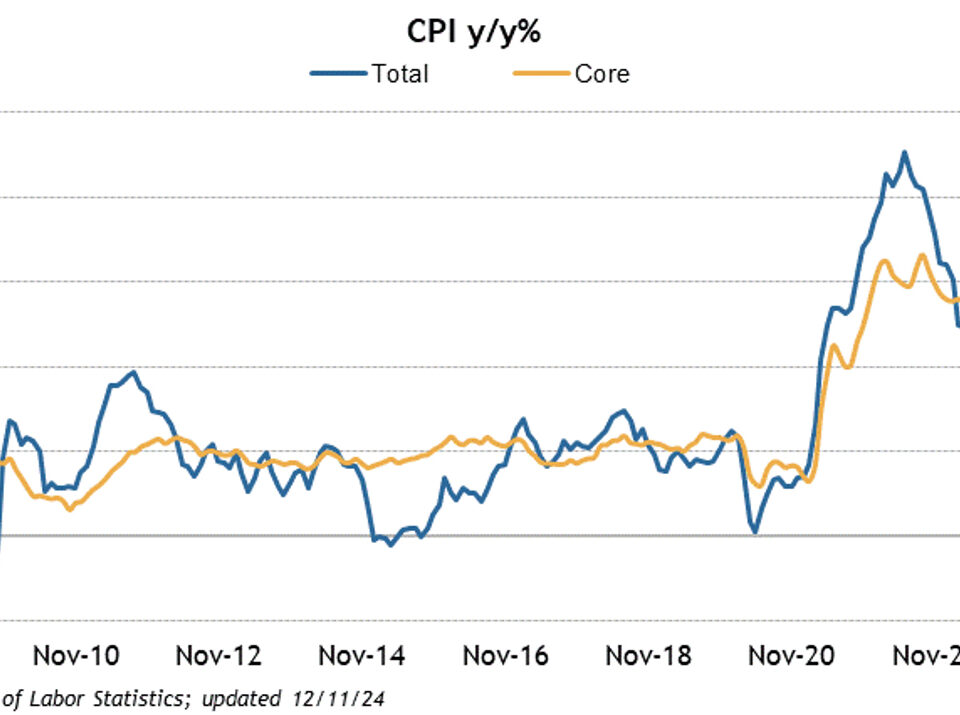

The economic calendar was relatively quiet. Housing Starts and Permits were weaker than expected as Existing Home Sales topped estimates. S&P Global Manufacturing and Services PMI data were weak globally, but Eurozone data was materially weaker than anticipated. In the US, Services data indicated further expansion, coming in at 57 versus 55 in October. Manufacturing in the US remained in contraction, but the pace of contraction was less than in October. Initial Jobless Claims fell by 6k to 213k, while Continuing Claims increased by 36k to 1908k. The final reading of the University of Michigan’s Consumer Sentiment Index came in at 71 versus the consensus estimate of 73.

Weekly Market Commentary – 12/30/24

Read more