Market Commentary 3-28-24

March 28, 2024

Weekly Market Commentary 4/12/2024

April 12, 2024

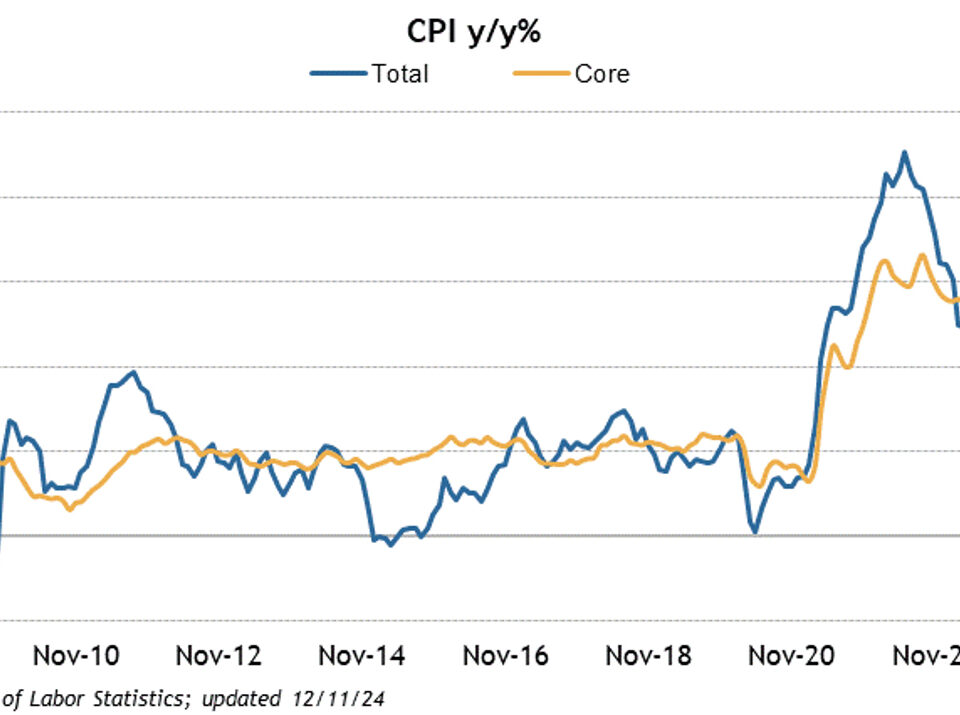

Wall Street took a step back in the first week of the second quarter as robust economic data induced a recalibration of rate cut expectations. The recalibration was further influenced by Minneapolis Fed Governor Neel Kashkari's suggestion that the Fed may not need to cut rates this year if inflation remains elevated, a statement that arguably hit the market Thursday afternoon. Earlier in the week, Fed Chairman J. Powell echoed his prior statements that the Fed’s next move would likely be cutting rates but anchored that statement to data dependency which leaves the Fed with plenty of options.

A sense that Iran is prepared for retaliation on Israel and or United States assets in the region in response to the airstrike on its embassy in Syria that killed 7 Iranian officials was also cited as a possible catalyst to sell risk assets on Thursday afternoon. The move lower in equities coincided with a safe-haven bid into US Treasuries and a bid into the oil market.

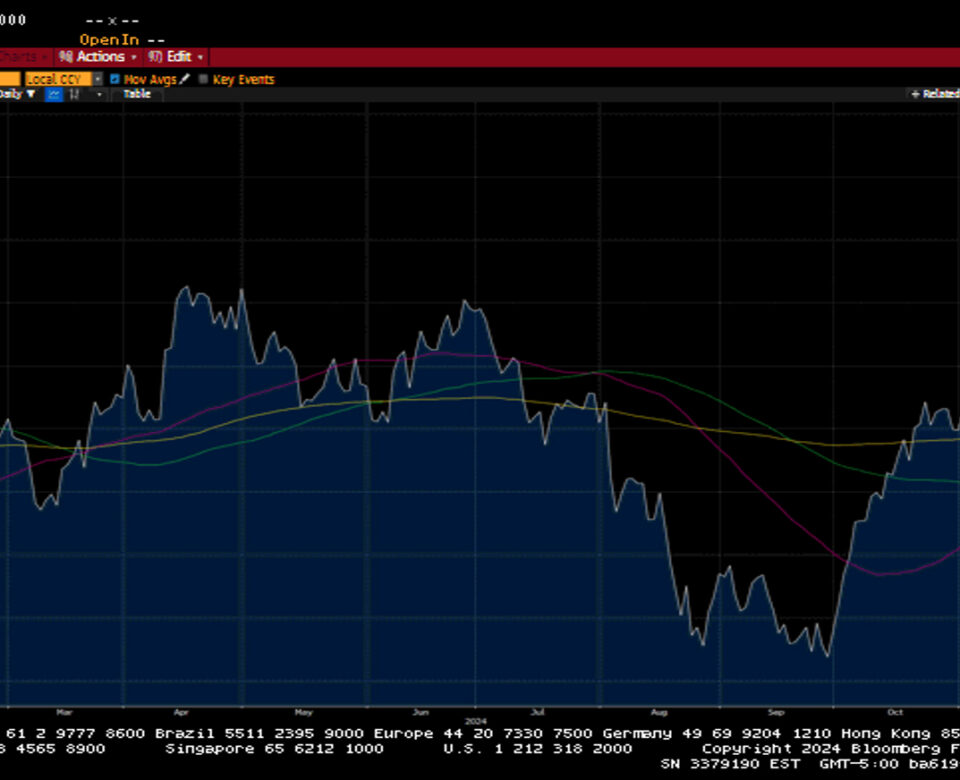

The late afternoon move lower on Thursday stands out because it was a meaningful reversal from sizeable gains forged earlier in the session. Technically, the S&P 500 looks overbought at these levels, so the narrative that the market needs a pullback seems warranted. The S&P 500 has traded above its 50-day moving average by over one standard deviation for over 50 days. Price action in market leadership was lackluster as well and may also give a reason for pause.

A blockbuster Employment Situation Report on Friday prompted a broad-based rally that reversed the losses incurred on Thursday. Friday’s rally derived from the idea that if the labor market remains resilient, the consumer will spend, leading to solid corporate earnings. By the way, the second-quarter earnings season will start in earnest this coming week, with the financials on deck to report results in the latter part of the week.

The energy and communication services sector inked gains for the week, while all the other sectors ended in the red. The healthcare sector was particularly weak as the government announced that it would keep the Medicare Advantage Plan rate unchanged at 3.7% when many were expecting an increase. United Healthcare, Elevance Health, CVS, and Humana sold off in the wake of the announcement.

The S&P 500 lost 1.1%, the Dow shed 2.4%, the NASDAQ fell by 0.9%, and the Russell 2000 gave back 3%. US Treasuries sold off across the curve. The 2-year yield increased by eleven basis points to 4.73%, while the 10-year yield jumped by fifteen basis points to 4.38%. Bonds sell-off when their yields increase. Commodities continued to show relative strength. West Texas Intermediate crude closed the week 4.3% higher at $86.60 a barrel. Gold prices increased by $105.90 or 4.7% to a record high of $2345.30 an Oz. Copper prices advanced by $0.23 or 5.7% to close at $4.24 per Lb. The US Dollar index fell by 0.2% to 104.30.

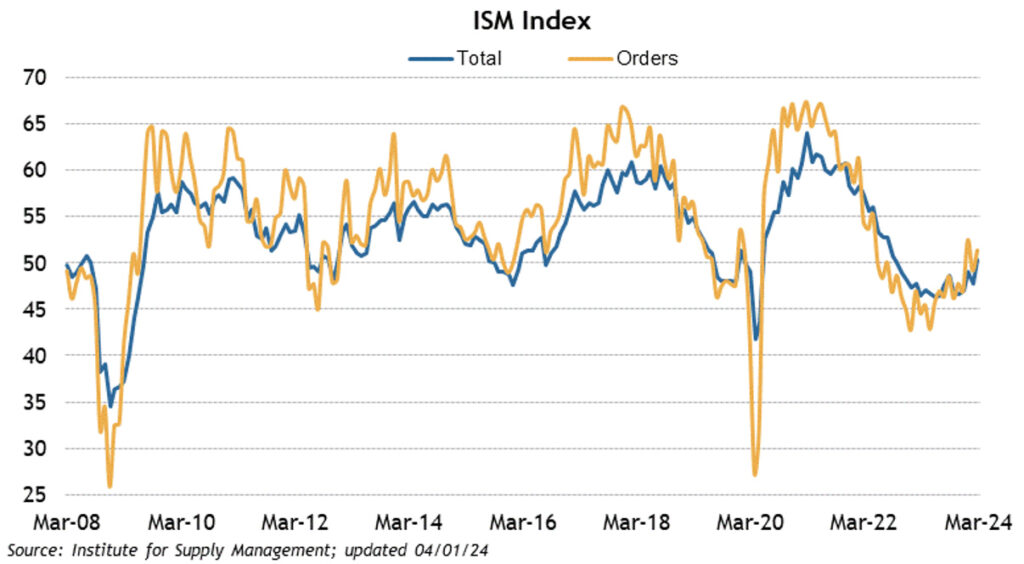

The economic calendar was all about Friday’s Employment situation report. The much stronger-than-expected report showed 303k Non-farm payrolls versus street expectations of 200k. Similarly, Private payrolls grew by 232k versus an expected 160k. The Unemployment rate stayed at 3.8%, relative to the consensus estimate of 3.9%. Average hourly earnings increased by 0.3%, which was in line with expectations. On a year-over-year basis, Average Hourly earnings increased by 4.1% in March, down from 4.3% in February. The Average Workweek increased to 34.4 from the expected 34.3. Initial Claims ticked up by 9k to 221km, while Continuing Claims fell by 19k to 1.791M. ISM Manufacturing showed expansion for the first time in 16 months. The reading came in at 50.3, well above the estimate of 47.8. ISM Services came in a little lighter than expected at 51.4 and was down from the previous reading of 52.6.

Weekly Market Commentary – 12/30/24

Read more