Weekly Market Commentary – 5/17/24

May 17, 2024

Weekly Market Commentary – 6/7/24

June 7, 2024

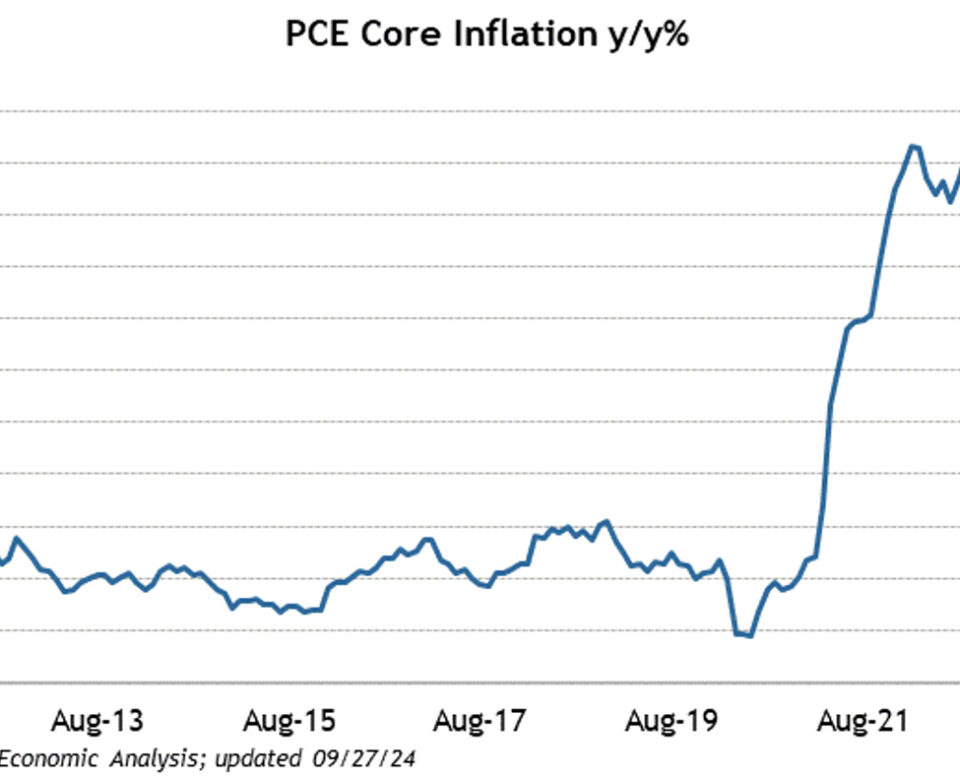

Financial markets ended the week with mixed results. All eyes this week were on AI darling NVidia, which posted better-than-expected Q1 results and provided guidance above the consensus estimates. The company also increased its dividend by 150% and announced a ten-for-one stock split, sending shares higher by 9%. Arguably, NVidia’s results were the most important Q1 earnings report of this earnings season and confirmed that the AI trend is still intact, which portends continued capital expenditures on AI by global corporations. Markets also took cues from the FOMC minutes that reinforced the notion of higher for longer but noted that most on the committee thought that current monetary policy was sufficiently restrictive. Next week, investors will get a look at the Fed’s preferred measure of inflation, the PCE, which is likely to show continued moderation in inflation.

The S&P 500 closed the week unchanged, while the NASDAQ gained 1.5% and established a new all-time high. The Dow lost 2.4%, and the Russell 2000 shed 1.3%. US Treasuries sold off across the curve, with shorter-tenured paper taking the bulk of the losses. The 2-year yield increased by thirteen basis points to 4.95%, while the 10-year yield rose by four basis points to 4.46%. The 2-10 spread compressed to -49 basis points. Commodities were weak across the board as some of the most recent sizeable gains in precious metals regressed. West Texas Intermediate crude prices declined by $1.73 or 2.2% to close at $77.81 a barrel. Gold prices fell by $83.30 to close at $2334.80 an Oz. Copper prices lost $0.30 or 5.4% to $4.75 per Lb. The US Dollar index added 0.3% to close at 104.69

.

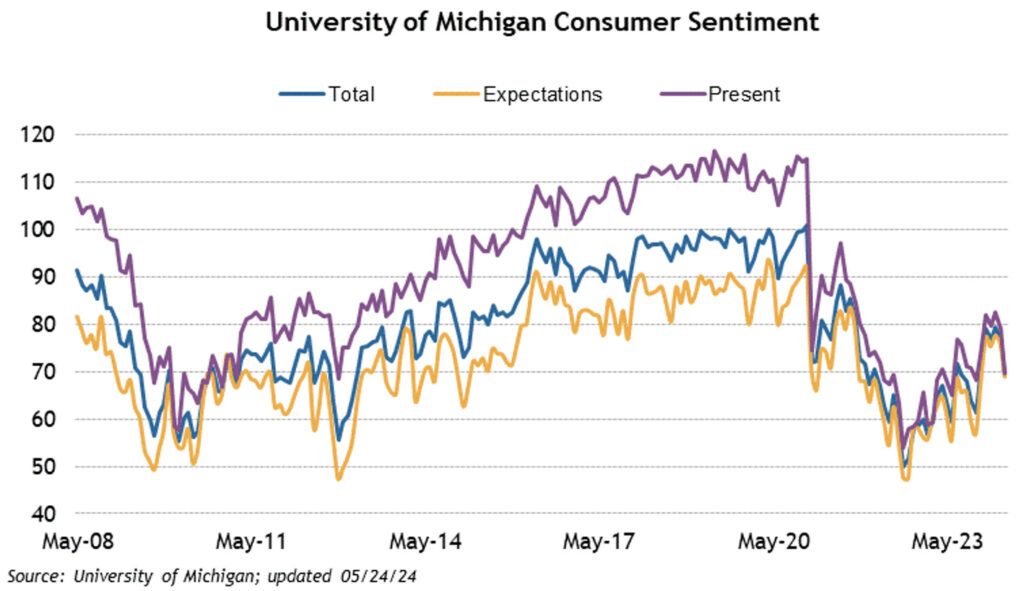

The economic calendar was relatively quiet this week, but there were a couple of notable data sets. The preliminary S&P Global Manufacturing and Services PMIs showed increased expansion. The manufacturing PMI came in at 50.09 versus an expected 50 print, while the services PMI came in at 54.8 versus the expected reading of 51.3. This increased activity bolstered the idea that the Fed will continue to hold rates higher for longer and pushed out expectations of a rate cut. There is currently a 49.4% probability assigned to a rate cut in September, a 61.6% chance in November, and an 81.6% probability for a December rate cut. The final reading of the University of Michigan’s Consumer Sentiment index came in at 69.1 versus an expected 67.6. This was the lowest reading in 5 months but showed consumer’s inflation expectations moderating over the next year and in the long run.

Weekly Market Commentary – 10/14/24

Read more