Weekly Market Commentary 4/26/2024

April 29, 2024

Weekly Market Commentary – 5/10/24

May 10, 2024

It was an extremely busy week on Wall Street. First-quarter earnings results were highlighted by Apple and Amazon. Investors encouraged by their results sent higher shares on the back of increased dividends, increased share buyback programs, and increased AI capital expenditures. The May FOMC meeting yielded no change to the Fed’s policy rate, which stays at 5.25%- 5.50%. However, Chairman Jerome Powell came off much more dovish than expected. The Chairman said that it was unlikely that the Fed would raise rates despite the lack of further progress over the last couple of months toward reaching the Fed’s inflation target. This statement, coupled with a weaker-than-expected Employment Situation Report, sent US Treasury yields lower on the week and recalibrated the timeline for when the Fed is expected to start cutting its policy rate from December to September.

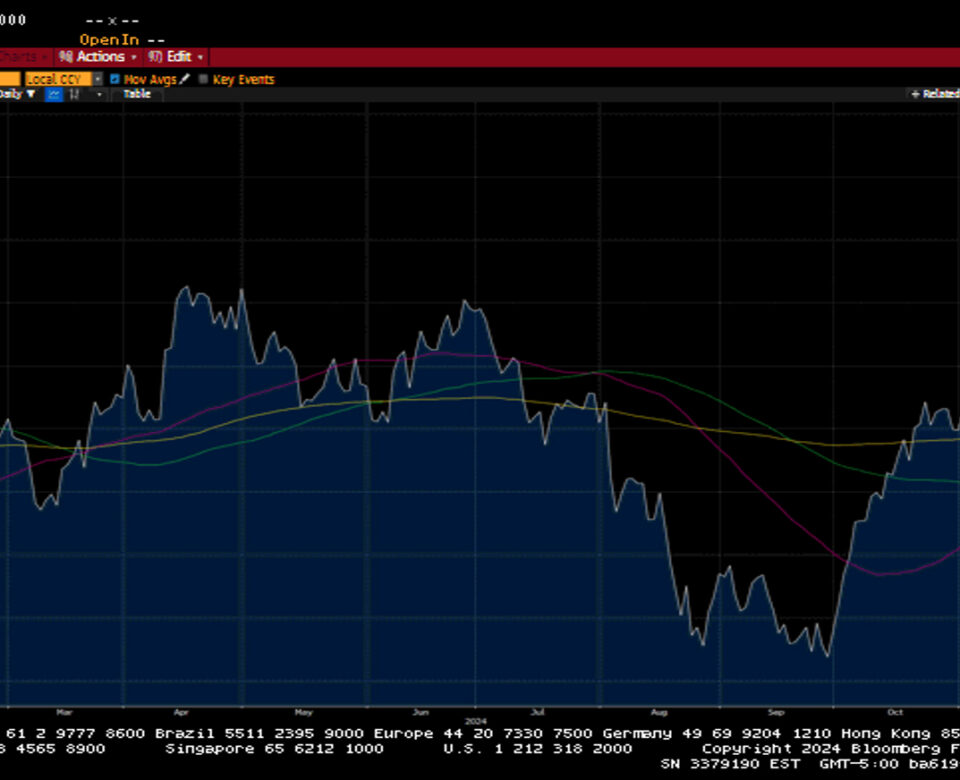

The S&P 500 gained 0.5%, the Dow rose 1.1%, the NASDAQ climbed 1.4%, and the Russell 2000 advanced by 1.7%. The S&P 500 sits right below its 50-day moving average, while the NASDAQ was able to trade and settle above its 50-day moving average. US Treasuries gained across the curve, with shorter tenors slightly outperforming. The 2-year yield fell nineteen basis points to 4.81%, while the 10-year yield decreased by seventeen basis points to 4.50%. Talks of a ceasefire in Gaza took some of the risk premium out of the crude market. WTI prices fell by nearly 7% on the week and closed at $78.05 a barrel. Gold prices fell by $39.70 or 1.6% to $2308.20 an Oz. Copper prices fell by two cents to $4.55 per Lb. The US Dollar index fell on the reset of rate cut expectations and a strong currency intervention by the Bank of Japan to strengthen the Yen. Last Sunday, the Yen touched 160 and closed Friday at 152.95. The DXY closed the week down 1% at 105.04.

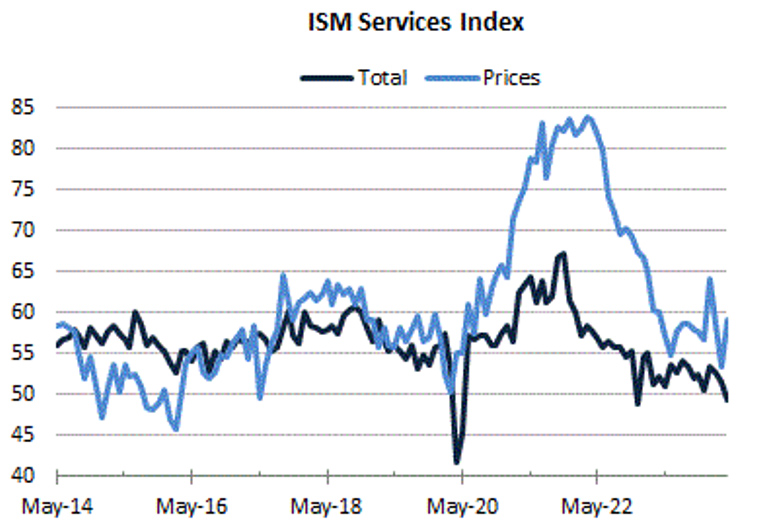

The economic calendar was full this week. The Employment Situation Report surprised to the downside. Non-farm Payrolls increased by 175k versus the consensus estimate of 250k. Private Payrolls were up by 167k versus the estimate of 175k. The Unemployment rate ticked up by .1% to 3.9% higher than the expected 3.8%. Average Hourly Earnings increased by 0.2%, but was lower than the expected increase of 0.3%. The Average Workweek was also lower than expected at 34.3. The report supports the idea that the economy is still doing well and also supports the idea that the next move by the Fed will be a cut. That said, the week started with a stronger-than-anticipated Employment Cost Index, which increased by 1.2% and catalyzed a broad sell-off in the markets. April Consumer Confidence fell to 97 from the prior reading of 104. Initial Claims and Continuing Claims were flat over the prior week, coming in at 208k and 1.744m, respectively. ISM Manufacturing came in at 49.2, indicating that the manufacturing sector is in contraction, while the ISM Services reading came in at a surprising 49.4, also indicating that the services sector has entered into contraction.

Weekly Market Commentary – 12/30/24

Read more