Weekly Market Commentary – 6/7/24

June 7, 2024

Weekly Market Commentary – 6/21/24

June 21, 2024

US Markets finished the second week of June with mixed results. It was an extremely busy week for investors as key Central Bank policy decisions were announced outside of a full economic calendar centered on two key inflation data sets. There was also plenty of geopolitics to digest. A proposed ceasefire in Gaza was assessed by Israel and Hamas with no final agreement. A snap election called by French President Emmanuel Macron highlighted the changing landscape of European politics and sent European markets lower. This came as the G7 meeting in Italy addressed the current situation between Europe and Russia and the influences of China’s overcapacity and unfair trade practices.

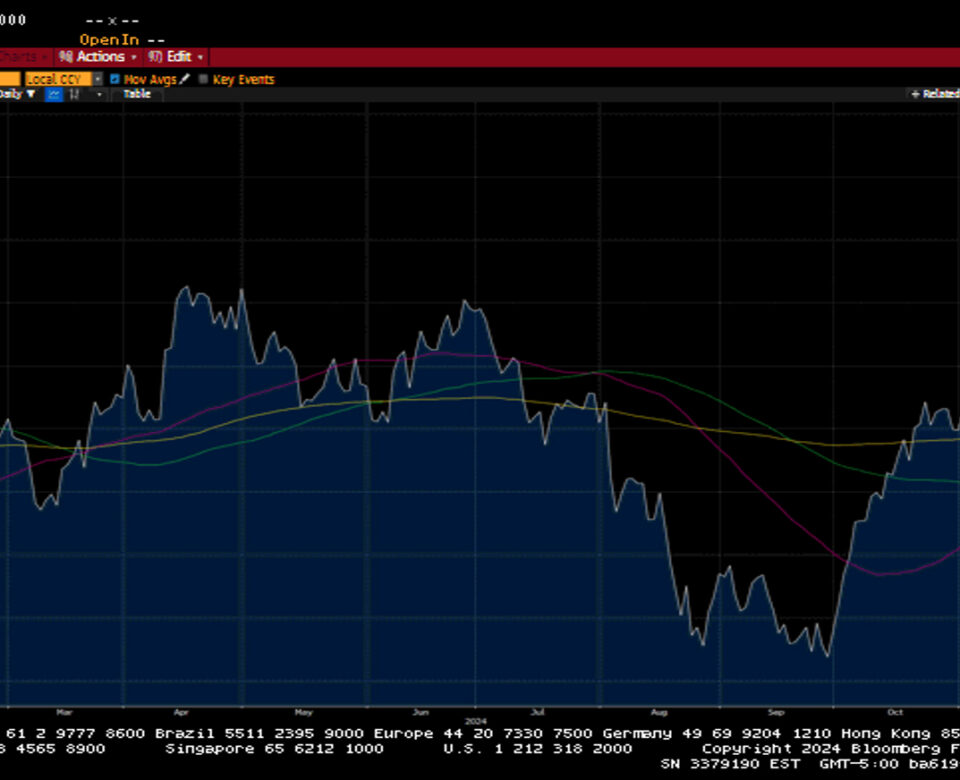

The Federal Reserve finished its two-day meeting on Wednesday announcing that its current monetary policy rate would remain the same. The Fed also delivered its most recent Summary of Economic Projections, increasing its forecast of inflation and lowering its forecast of rate cuts to one from three. Markets sold off a bit on the new SEP and the slightly more hawkish tone from Fed Chairman Powell but did manage to retain nice gains after a weaker-than-expected May CPI print put a bid into the markets earlier in the day. On Friday, the Bank of Japan announced that there would be no change to its policy rate and gave very little details on its quantitative easing program. The news sent the Japanese Yen lower and hit Japanese equities. However, Japanese markets stabilized after BOJ Governor Ueda suggested that QE reductions would be articulated in July and expected them to be sizable.

The S&P 500 gained 1.6% on momentum in the mega-caps. The Dow fell by 0.5%, the NASDAQ increased by 3.2%, and the Russell 2000 fell by 1%. Apple’s developer conference drove its shares higher, while shares of NVidia continued to rally after its ten-for-one stock split was exercised. Broadcom announced strong earnings, which helped propel technology issues higher, as did Adobe.

The US Treasury market continued to be volatile. Treasury yields fell across the curve by double digits as inflation data showed signs of weakening. The 2-year yield fell twenty basis points to close at 4.69%, while the 10-year yield decreased by twenty-two to 4.22%. Of note, a weak 3-year Treasury auction was followed by a solid 10-year and 30-year auction, this strong demand also fostered yields lower. Despite yields moving lower, the US dollar index rallied on a weaker Euro and Yen.

Oil prices increased by 1.3% or $2.58 to close at $78.08 a barrel. Gold prices jumped by $25.70 to $2349.60 an OZ. Copper prices rose by $0.03 to $4.50 per Lb.

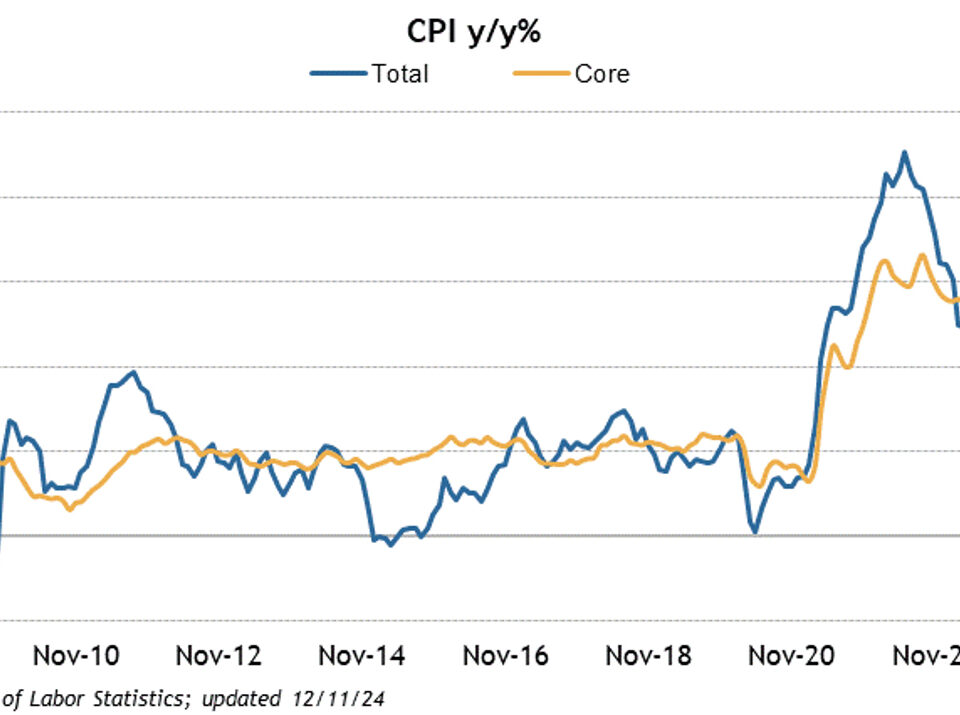

The Economic calendar was highlighted by weaker inflation data. Headline CPI came in flat versus an expectation of an increase of 0.1%. Core CPI, which excludes food and energy, rose 0.2%, lower than the anticipated 0.3%. On a year-over-year basis, May's CPI increased by 3.3%, down from April’s 3.4%, while the Core reading rose 3.4% in May versus an increase of 3.6% in April. Similarly may headline PPI fell 0.2% versus an expected gain of 0.1%. Core PPI came in flat, while the street was looking for an increase of 0.3%. PPI increased 2.2% annually, 0.1% lower than the April print, while the Core PPI increased by 2.3%, 0.2% lower than the prior month’s reading. Initial Jobless Claims increased by 13k to 242k, and Continuing Claims rose by 20k to 1.82 million. These are modest increases but may be an indication that the labor market is weakening. Interestingly, Fed Chairman Powell suggested that the May Non-Farm Payrolls figure was likely too high and will possibly need to be revised lower. Finally, the University of Michigan Consumer Sentiment Index surprised to the downside, coming in at 65.6, well below expectations of 73. The fall came from the assessment that personal finances have weakened.

Weekly Market Commentary – 12/30/24

Read more