Weekly Market Commentary – 6/21/24

June 21, 2024

Weekly Market Commentary – 7/5/24

July 5, 2024

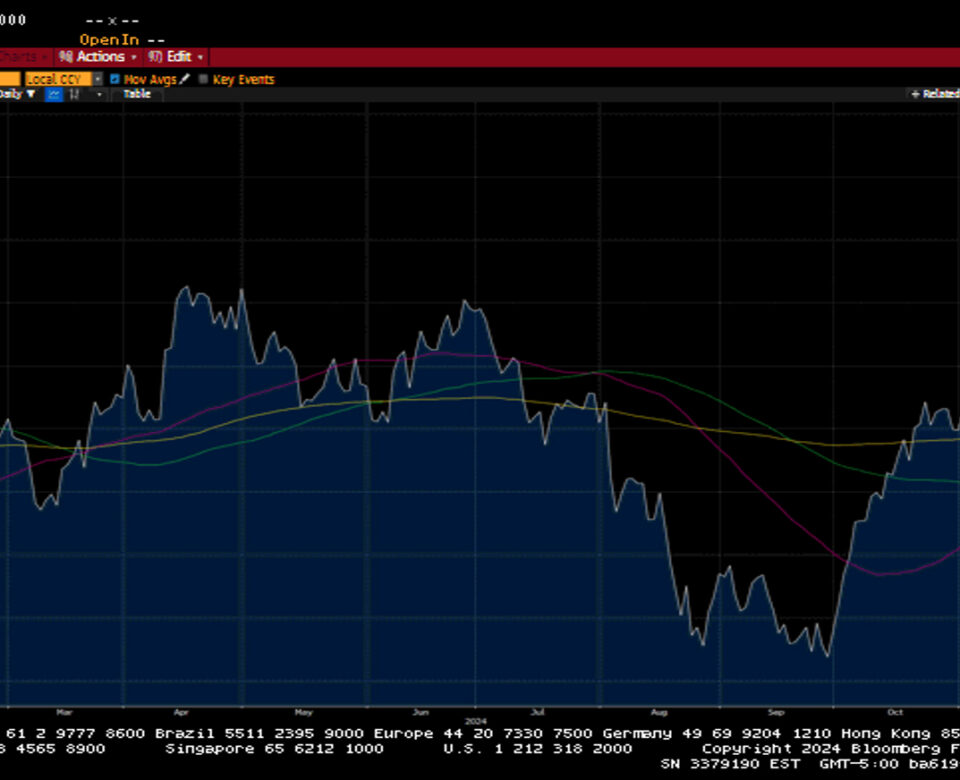

Financial markets finished the 2nd quarter with a lack of conviction. Mega-caps led the market over the quarter with a 9.65% gain, while the equally weighted S&P 500 index declined by -2.42%, and the market weight S&P index gained 4.13%.

The final week of the quarter saw Amazon’s market eclipse $2 trillion, even as investors increasingly questioned the Mag Seven’s market leadership. Micron Technology’s quarterly results beat estimates, but high expectations were not met, and the company’s shares fell sharply on the news. Consumer-focused Walgreens and Nike disappointed investors with poor results and cautious outlooks. The Fed’s stress test of 31 banks came back with passing results and induced announcements from many banks that they would increase their dividends and share buy-back programs.

The much anticipated Presidential debate between President Biden and former President Trump left many questioning President Biden’s ability to lead for a second term. The uncertainty of who, if any, might replace him on the democratic ticket and what policy changes it may invoke will undoubtedly impact markets. A Trump victory will likely do little to remedy the current deficit and likely raise tariffs on most of our trading partners which some suggest will hit long-duration US Treasuries and agitate the inflation outlook.

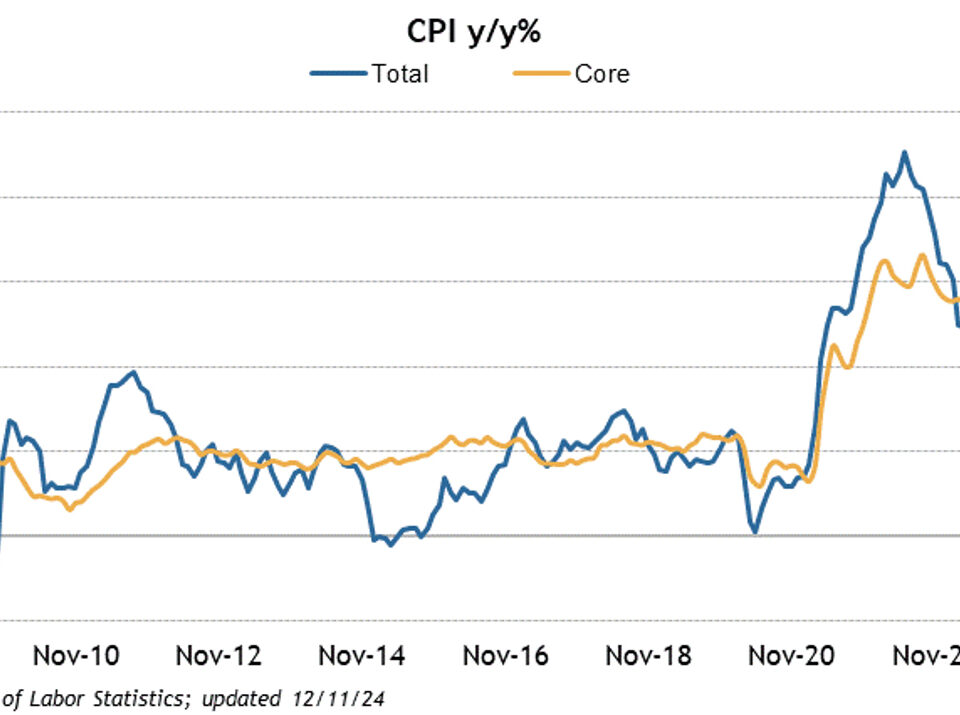

Fed rhetoric was heard throughout the week. Bowman indicated that there is still an upside risk to inflation, Fed President Cook expressed that it would be appropriate to cut rates sometime this year, and Bostic said he expects one rate cut by the end of the year.

The S&P 500 and Dow gave back 0.1%, the NASDAQ increased by 0.2%, and the Russell 2000 advanced 1.3%. Year to date, the S&P 500 is up 14.5%, the Dow is up 3.8%, the NASDAQ is up 18.1, and the Russell 2000 is up 1%. US Treasuries saw strong demand in the 2, 5, and 7-year auctions. However, Treasuries lost ground across most of the yield curve. The 2-year yield decreased by one basis point to 4.72%, while the 10-year yield increased by eight basis points to close the quarter at 4.34%. Oil prices increased by $0.83 or 1% to $81.53 a barrel. Gold prices increased by $7.70 to $2339.30 an Oz. Copper prices fell by $0.05 to close at $4.39 per Lb. Continued pressure on Bitcoin saw the cryptocurrency trade below $60k, but the coin recovered slightly, ending the week at $60,909. The US Dollar index increased by ten basis points to close at 105.90, marking the sixth straight week of gains.

The economic calendar showed progress on inflation, but increased concerns about inflation, business conditions, the job market, and incomes showed up in the sentiment indicators released this week. The Fed’s preferred measure of inflation, the PCE, came in flat month-over-month and increased 2.6% year-over-year, down from 2.7% in April. The Core reading, which excludes food and energy, increased by 0.1%, in line with expectations, and fell to 2.6% on a year-over-year basis from 2.8% in April. Personal Income increased by 0.5% in May, while Personal Spending rose by 0.2%, lower than the anticipated 0.4%. The combination of moderating inflation while incomes rose and spending increased by less than expected supported the narrative that the Fed is making progress and may be able to cut rates before year-end. That said, concerns continue to brew over the labor market. Initial claims fell by 6k last week to 233K, but Continuing claims rose by 18k to 1.839M, the highest level since November 2021. New Home Sales remain weak, coming in at 611k units versus an expected 660k. The University of Michigan’s final June reading of the Consumer Sentiment index was 68.2 versus the expected 65.6. However, the Consumer Confidence Index was 100.4, below the expected 101.5 level.

Weekly Market Commentary – 12/30/24

Read more