Weekly Market Commentary – 7/12/24

July 12, 2024

Weekly Market Commentary – 7/26/24

July 26, 2024

It was a very busy week on Wall Street as investors seemed inclined to rotate out of Mega-cap tech and into this year’s laggards. A failed assassination attempt on former President Donald Trump last Saturday in Pennsylvania only bolstered his chances for reelection and came just before the start of the Republican National Convention. Interestingly, President Biden’s troubled campaign was given a bit of cover as Trump headlines dominated. However, that cover dissipated over the week as more congressional democrats called for Biden to exit the race and also on the announcement that the President had contracted COVID, increasing concerns about his fragility. Markets will likely be volatile over the next several months solely based on increased election headlines as investors digest the most recent policy rhetoric twists.

Rhetoric from President Biden on further restrictions of technology exports to China and increased penalties on companies that do not comply catalyzed a selloff in the semiconductor sector. The selloff was strengthened further by comments from former President Trump that suggested that Taiwan, a significant exporter of semiconductors, would need to pay for the US to defend it from China. This, coupled with a weaker-than-expected 3rd quarter outlook from semiconductor chip equipment maker ASML, gave investors a reason to sell tech. If that was not enough, a software update from cybersecurity firm CrowdStrike for Microsoft’s operating system late in the week caused a massive computer shutdown across multiple industries and induced more selling.

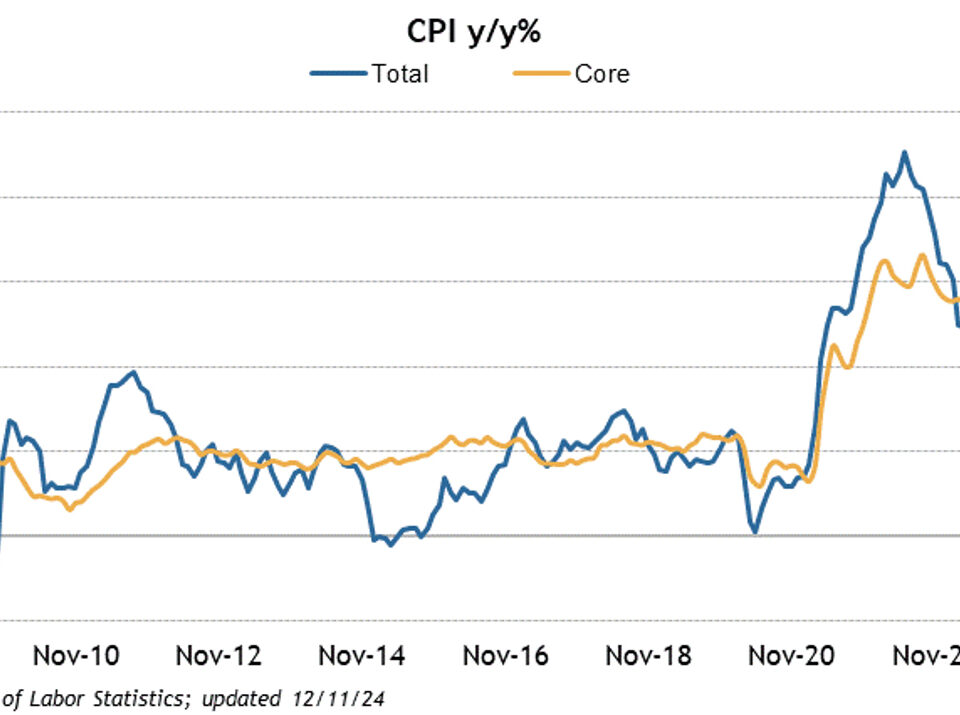

The European Central Bank announced that it would keep its policy rate in place, but post-statement comments from President Lagarde suggested that a rate cut was probable at the September meeting. Weakening inflation data in the US, alongside a labor market that appears less robust, has pushed the probability of the Federal Reserve cutting rates in September to 98.1% and has increased the likelihood of two more cuts later in the year.

Second-quarter earnings continued throughout the week and were, for the most part, quite good. Bank of America and Goldman Sachs had solid quarters, as did United Health Care, Johnson and Johnson, Taiwan Semiconductor, and Netflix. On the other hand, Elevance Healthcare and ASML were disappointments. This week, we will see results from Tesla and Google. Their results will likely set the tone for the broader market this week.

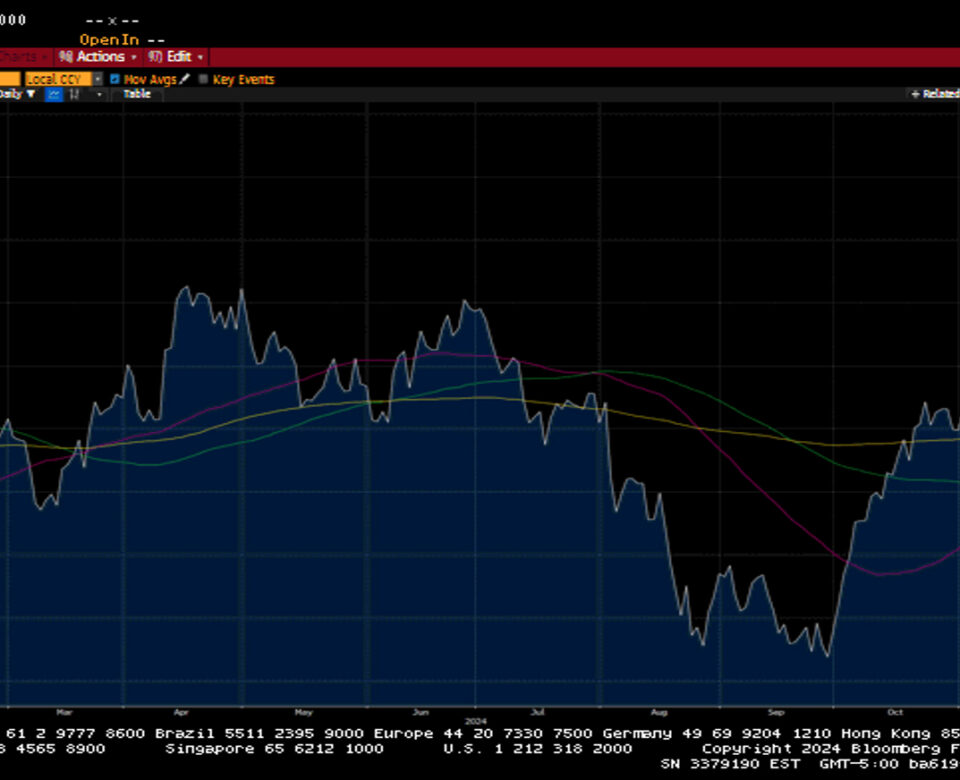

The S&P 500 fell 2.3%, the Dow gained 0.9%, the NASDAQ tumbled 4.5%, and the Russell 2000 added 1.8%. US Treasuries sold off evenly across the curve. The 2-year and 10-year yield increased by five basis points to 4.51% and 4.24%, respectively. Oil prices fell 4.2% or $3.50 to $78.69 a barrel. Gold prices traded lower by $20.90 to close at $2399.50 an Oz. Copper was hammered, losing 7.6% on the week, to close at $4.24 per Lb. Bitcoin continued to bounce off its most recent lows, closing at ~$66,600. The US dollar index gained 0.3% and closed at 104.39.

Retail sales showed a resilient consumer. The headline number was flat versus the street’s expectation for a decline of 0.3%. The Ex-auto number, influenced greatly by the shutdown of several Auto Dealerships in the period, came in much stronger at 0.4% versus expectations of a flat reading. Housing Starts and Building Permits were also stronger than expected. Initial Jobless Claims increased by 20k to 243k, while Continuing Claims increased by 20k to 1867k. The weaker employment data adds to the argument for a September rate cut by the Fed.

Weekly Market Commentary – 12/30/24

Read more