Weekly Market Commentary – 8/12/24

August 12, 2024

Weekly Market Commentary – 8/26/24

August 26, 2024

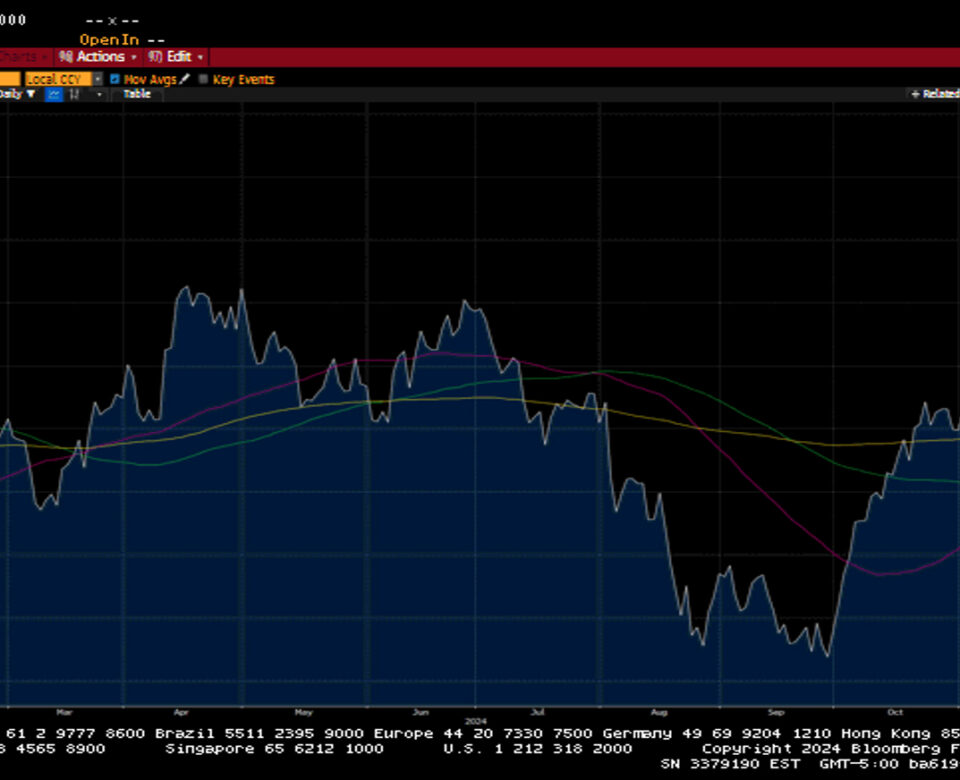

Markets reversed course last week as investors reassessed the economic narrative of a recession. Better-than-expected inflation data, alongside a robust reading of Retail Sales and a pullback on Initial Jobless Claims, tempered fears of a severe economic slowdown and gave investors reasons to buy the most recent market sell-off. Highlights from the tail culmination of second-quarter earnings included solid results from Walmart and Cisco Systems and disappointing results for Home Depot. Corporate news was also prevalent over the week and included news that the Department of Justice intends to break up Google, Kellanova is to be acquired by Mars for $36 billion, and Starbucks has replaced the current CEO with the CEO of Chipotle Mexican Grill.

The S&P 500 gained 3.9%, the Dow rose 2.9%, the NASDAQ advanced 5.3%, and the Russell 2000 increased 2.9%. The US Treasury market endured a volatile week but ended the week little changed. The 2-year yield increased by one basis point to 4.06%, while the 10-year yield jumped five basis points to 3.89%. Oil prices fell by $1.25 or 1.6% even as traders awaited an eminent attack by Iran on Israel. Ceasefire negotiations appeared to have stalled after an Israeli attack in Lebanon killed at least ten people, including children. Gold prices increased by $63.50 to $2537.40 an Oz. China’s central bank reportedly continues to add to its gold stockpile. Copper Prices increased by $0.15 or 3.75% to $4.15 per Lb. Bitcoin fell below $60k to $59,286. The US Dollar index fell by 0.67 to 102.49, but the Dollar did gain ground against the Japanese Yen, with the cross closing at 147.64.

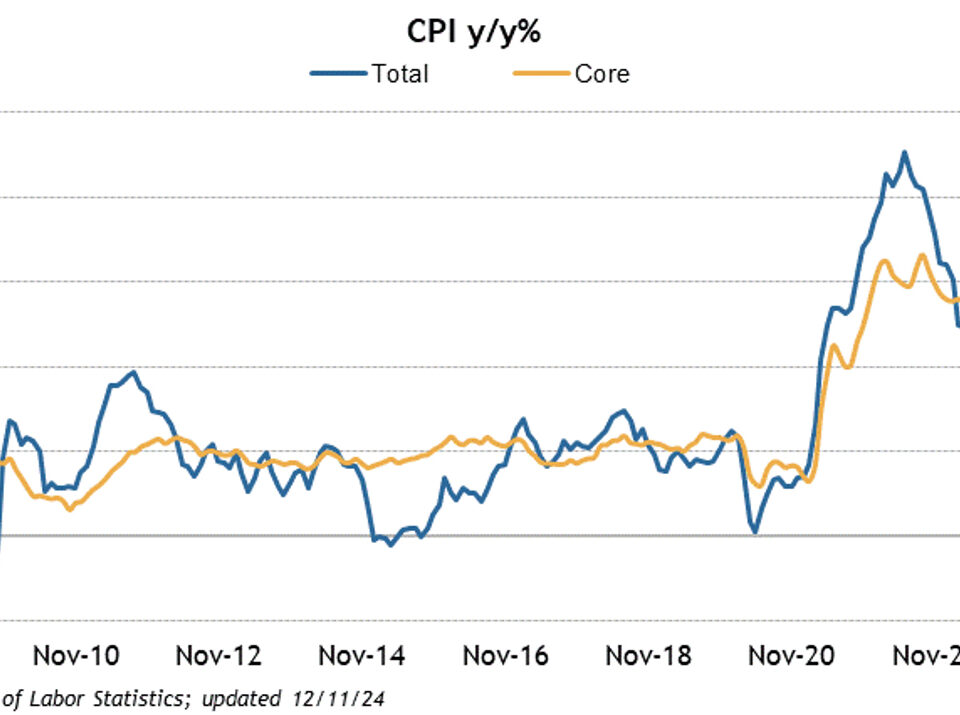

The economic calendar was busy this week, and as I mentioned, key data helped reverse the economic narrative of a hard landing. The Fed Funds futures now suggest a 75% probability of a twenty-five basis point cut by the Fed in September. The Producer and Consumer Price indexes showed continued progress on the inflation front. Headline PPI increased by 0.1%, in line with expectations, and increased by 2.2% in July year-over-year, down from 2.7% in June. Core PPI was flat in July, which was below expectations, and grew 2.4% year-over-year, down from 2.9% in June. Headline and Core CPI increased by 0.2% in July, in line with the street’s consensus estimate, while the Headline number grew by 2.9% year-over-year, down from 3% in June, and the Core reading grew by 3.2%, down from 3.3% in June. The numbers suggest the Fed has made further progress on inflation and, at least on the inflation front, gives them the green light to cut their policy rate. Retail sales were much better than expected. The headline number increased by 1% in July- the street was looking for an increase of 0.3%. The Ex-Auto figure increased by 0.4% above the 0.2% consensus estimate. These numbers suggest that consumers continue to go out and spend, which helps the economic notion of a soft landing. Initial Claims for the week showed a decrease of 7k to 227K, and Continuing Claims came in at 1.854m, down 17k from the prior week. These numbers helped calm investors' nerves about a sharp decline in the labor market. The labor market is an important variable to watch going forward and will likely dictate Fed Policy in the coming months.

Weekly Market Commentary – 12/30/24

Read more