Weekly Market Commentary – 8/19/24

August 19, 2024

Weekly Market Commentary – 9/2/24

September 2, 2024

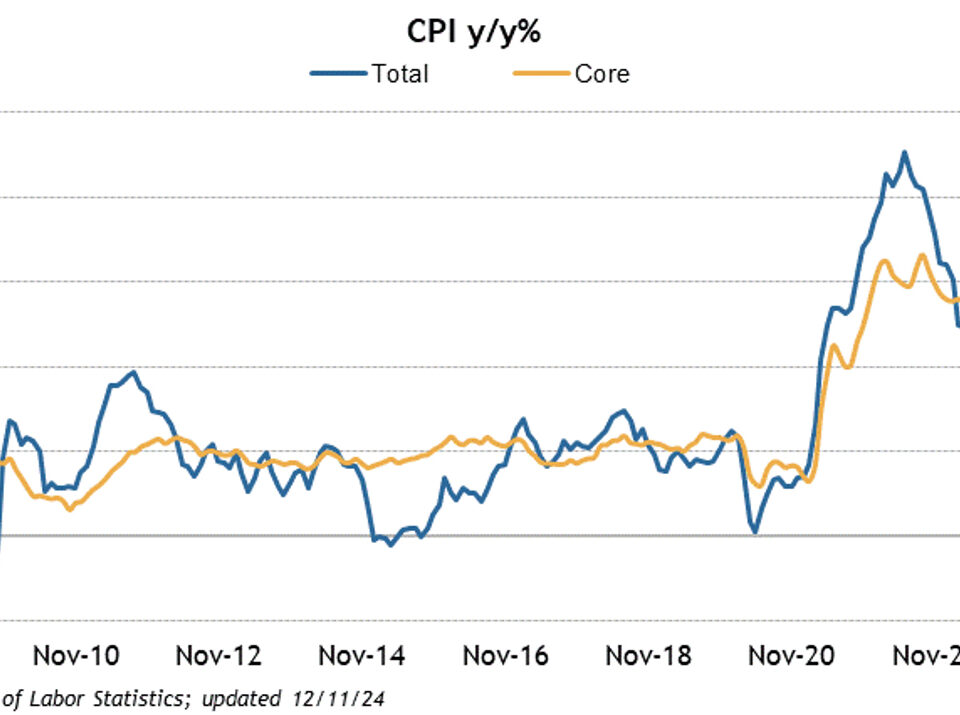

US financial markets inked another week of gains as investors cheered what they heard from global central bankers at the Jackson Hole Economic Symposium. In fact, the bulk of the gains were made on Friday after Fed Chairman Jerome Powell solidified the prospect of a September rate cut by acknowledging that the economy is growing at a solid pace as inflation moderates while the labor market appears to be cooling. Several Fed officials echoed that dovish tone, suggesting it is time for rate cuts in a methodical manner. Bank of England, Governor Andrew Bailey, and ECB officials in attendance also highlighted moderating inflation in their geographies and pointed to additional rate cuts at their September monetary policy meetings. There is currently a 76% chance of a twenty-five basis point cut at the Fed’s September meeting and a 24% chance of a fifty basis point cut. For the year, the market is pricing in just over 100 basis point cuts, which currently seems a bit aggressive to us. The labor market has now become the key to the direction of monetary policy, with the August payroll data seen as a highly influential number.

Harris and Walz accepted their nominations at the Democratic National Convention. Still, the four-day event offered little substantive policy, perhaps by design. Harris can now craft her policy agenda, keeping what worked in the Biden Administration and toggling to new positions on what did not work.

Corporate news included mixed results from the retail sector, where Target showed meaningful improvement, while Macy’s results were disappointing. Cybersecurity firm Palo Alto Networks had a fantastic quarter, beating estimates and raising guidance for the rest of the year. Eli Lilly showed that 94% of patients using their weight loss drug were less likely to develop diabetes. Finally, Bank of America shares came under some more pressure as Warren Buffet continued to be a seller of the stock.

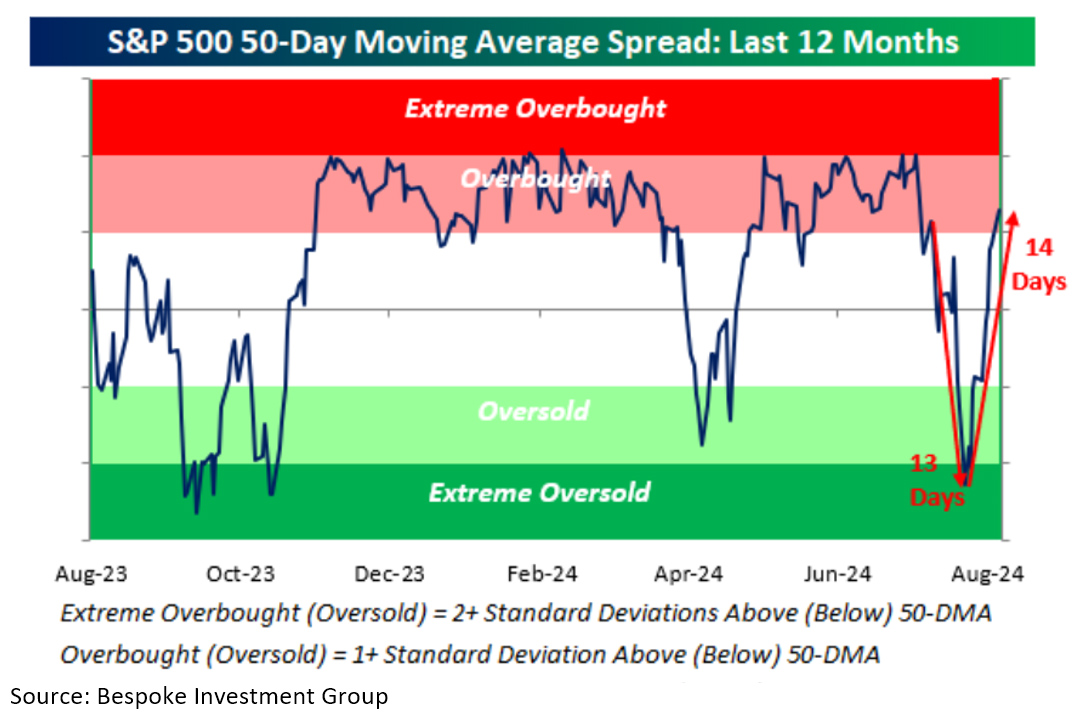

The S&P 500 gained 1.4% and 8% in eight days. The Dow added 1.3%, the NASDAQ was up by 1.4%, and the Russell 2000 outperformed with an increase of 3.6%. Notably, the gains come on light volume as much of Wall Street continues to be on summer vacation. The US Treasury market advanced across the curve after the dovish comments from J. Powell. Shorter-tenured Treasuries outperformed, which steepened the curve with the 2-10 spread ending at ten basis points. The 2-year yield fell by sixteen basis points to 3.91%, while the 10-year yield lost eight basis points to 3.81%. Oil prices fell by 0.9% to $74.87 a barrel. Gold prices increased by $9.60 to $2547.00 an Oz. Copper prices advanced by $0.06 to $4.21 per Lb. Bitcoin rallied nicely on the week, closing at just above $64,000. The Dollar index fell 1.7% to 100.66.

The economic calendar was pretty quiet. FOMC minutes confirmed the rhetoric out of Jackson Hole and allied the idea of a September rate cut. Revisions to the BLS payroll numbers showed that payrolls had been exaggerated by 818,000 or 68,000 per month from March of 2023 to March of 2024. Some suggest this massive revision should diminish the importance of the upcoming August payroll numbers. Initial Claims increased by 4k to 232k, while Continuing Claims increased by the same amount to 1863k. Global Manufacturing PMIs generally showed contraction; in the US, they came in at 48 versus the prior reading of 49.6. Global Services PMI data was better; in the US, it showed a small tick higher to 55.2. Existing Home Sales beat expectations at 3.95M, as did New Home Sales, which came in at 739k.

Weekly Market Commentary – 12/30/24

Read more