Weekly Market Commentary – 9/16/24

September 16, 2024

Weekly Market Commentary – 9/30/24

September 30, 2024

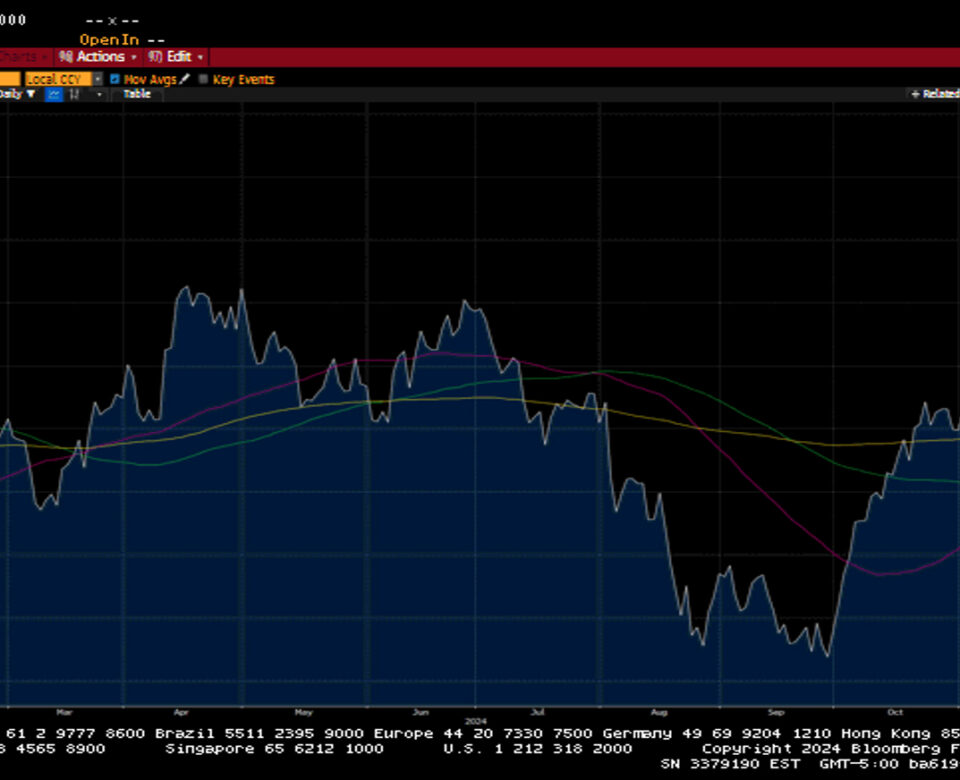

The S&P 500 notched its 39th record high in 2024 on the back of a fifty-basis-point rate cut by the Federal Reserve. Global central banks took center stage this week, with the Fed playing the headliner. Leading into the Fed’s decision, the street was divided over the magnitude of the cut but agreed that the message surrounding the decision would dictate market action. Notably, the market had a significant bounce in the prior week, and the rates market has significantly rallied over the last several weeks- so it felt like some of the rate cut decisions had already been baked into the market. The Fed’s decision to cut by fifty- basis points was immediately met with a bid into the markets, but that bid faded late in the day as markets settled back to little changed. Fed Chairman Powell cautioned the street’s expectations of continued big rate cuts despite the market pricing in another seventy-basis points of cuts in 2024 and over two hundred more in 2025. The Chairman's post-decision narrative was constructive and pointed to this fifty basis point cut as a recalibration of rates rather than a cut based on the economy falling into a recession. We think this statement bodes well for risk assets in the future, but we continue to expect continued volatility based on seasonality and into the US elections.

The Bank of England and the Bank of Japan left their policy rates in place. The BOE came across as more hawkish, telegraphing that they are in no rush to cut rates. On the other hand, the BOJ statements post-decision were taken as a bit more dovish and partially closed the door on the idea that the bank needs to raise rates in the near term. The US Dollar lost ground to the Euro and British Pound while strengthening against the Japanese Yen. The Dollar index fell 0.4% to 100.72

The S&P 500 gained 1.6%, the Dow also hit a record high and added 1.8%, the NASDAQ increased by 1.8%, and the Russell 2000 jumped by 2.2%. The broadening out of the market rally continued as the equal-weight S&P 500 index outpaced the market cap-weighted index. Small caps will likely continue to benefit as rate cuts continue, but only in situations where the overall economy is doing well.

US Treasuries took a small step back this week on what feels to be some consolidation of the curve’s recent strong move. The 2-year yield fell by one basis point to 3.57%, while the 10-year yield increased by eight basis points to 3.73%. Oil prices rose by $2.33 or 3.4% to close at $71.01 a barrel. Gold prices notched another all-time high before settling the week up $34.60 to close at $2645.90. Copper prices rose by $0.11 to $4.33 per Lb. Bitcoin ended the week materially higher on the risk-on trade, closing at $63,269.

The economic calendar this week showed a resilient economy. Retail Sales came in better than expected at 0.1%; the street was looking for a decline of 0.2%. Industrial production increased by 0.2% versus the estimated 0.1%. Capacity Utilization came in line at 78%. Initial Claims decreased by 12k to 219k, while Continuing Claims fell by the same amount to 1829k. Housing data also came in better than expected: Housing Starts at 1356k, Building Permits at 1475k, and Existing Home sales at 3.86M.

Weekly Market Commentary – 12/30/24

Read more