Weekly Market Commentary 3/8/2024

March 8, 2024

Weekly Market Commentary 3/22/2024

March 22, 2024

Markets pulled back this week as investors assessed hotter-than-anticipated inflation data. US Treasuries sold off across the curve as the higher-for-longer narrative strengthened ahead of the coming Federal Open Market Committee meeting. Investors are not expecting a change to the policy rate on Wednesday. However, they will be keenly focused on the new summary of economic projections that will show the Fed's view of the future path of the monetary policy rate- also known as the dot plot.

The S&P 500 fell by 0.1%, the Dow was unchanged, the NASDAQ declined by 0.7%, and the Russell 2000 lost 2.1%. US Treasuries had a tough week. The 2-year yield increased by twenty-three basis points to close at 4.72%, while the 10-year yield rose by twenty-one basis points to 4.30%. Oil prices increased by $2.94 or 3.8% to $80.99 a barrel. Gold prices declined by $25 to $2160.60 an Oz. Copper prices jumped 5.9% as China’s top copper smelters agreed to production cuts. Copper closed the week at $4.12 per Lb. Bitcoin touched another all-time high before settling back to around $68k. The US Dollar index gained 0.1% to 103.43.

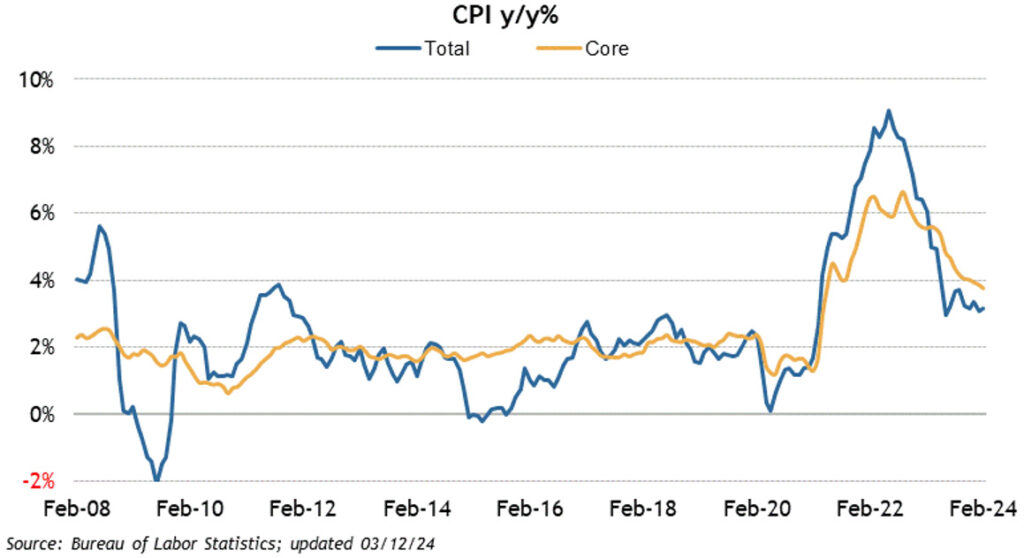

The economic calendar was highlighted by the Consumer Price Index and the Producer Price Index. Both readings came in hotter than expected. Headline CPI increased by 0.4% versus the street expectation of a 0.3% increase. On a year-over-year basis, the CPI increased by 3.2% in February versus a 3.1% gain in January. The Core CPI, which excludes food and energy, rose by 0.4% versus an estimated 0.3% increase and was up 3.8% year-over-year, down from 3.9% in January. Shelter costs continued to be sticky, gaining 0.4% in February. Headline PPI came in at 0.6%, much higher than the anticipated 0.3% increase. The year-over-year figure increased by 1.6% from January’s 0.9%. The Core number was up 0.3%, slightly above the 0.2% consensus estimate, and came in at 2% year-over-year, unchanged from January. Increased energy costs had a prominent influence on the headline number. Goods inflation ticked higher at the producer level. Retail sales got a nice bounce from January, rising 0.6%. The Ex-Autos Retail sales figure came in at 0.3%. The labor market continues to be tight as Initial Jobless claims fell by 1k to 209k. Continuing Claims rose by 17k to 1.811m. A preliminary look at the University of Michigan’s Consumer Sentiment index showed a decline of sentiment to 76.5 from 77.3 in February.

Weekly Market Commentary – 6/14/24

Read more