Weekly Market Commentary – 3/1/2024

March 1, 2024

Weekly Market Commentary 3/15/2024

March 15, 2024

Financial markets endured a week of consolidation as investors dissected a full economic calendar and awaited more cues from the leaders of the European Central Bank and the Federal Reserve. ECB President Lagarde and Fed Chairman Powell echoed each other about the need for more data before the central banks would cut rates. However, both leaders left the door open and expect rate cuts later in the year. A handful of fourth-quarter earnings reports were highlighted by retailers- Costco and Target, Semiconductor stock Broadcom, and Cybersecurity software company Crowd Strike.

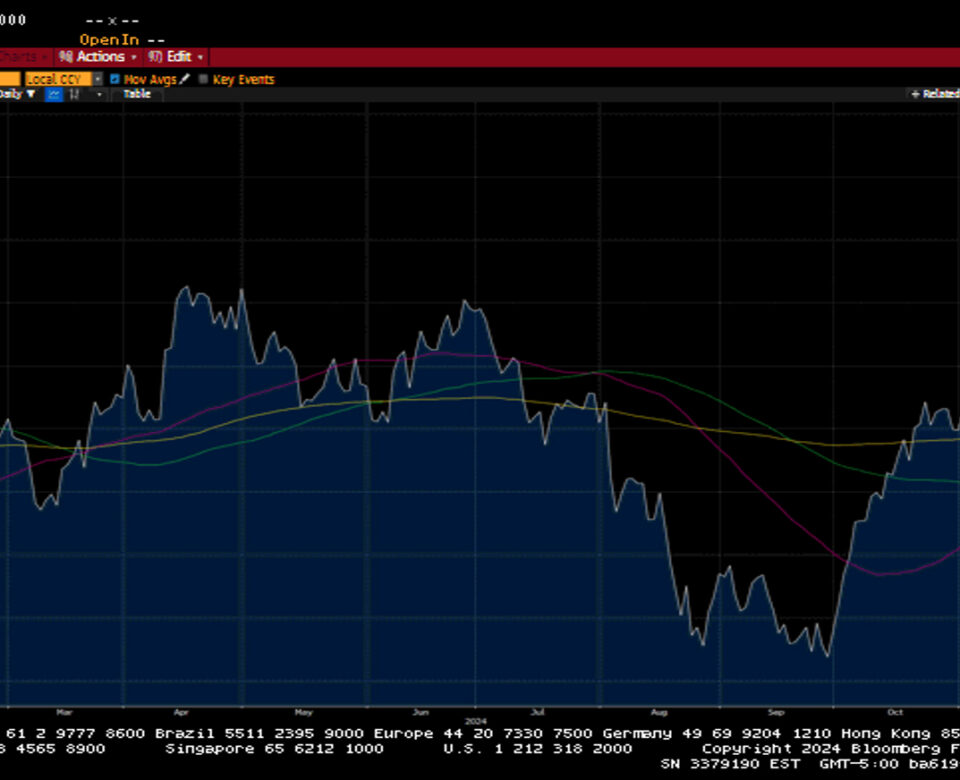

The S&P 500 gained 0.9% and is up 7.7% for the year. The Dow fell 0.1% even as Dow component Salesforce.comgained 8.2% on the week. The NASDAQ joined the S&P 500 and DOW with a new all-time high, adding 1.7% on the week and forging an 8.4% advance in 2024. The Russell 2000 outperformed with a 3% jump and turned positive for 2024. Interestingly, the market-weighted S&P 500 index underperformed the equal-weighted S&P 500 index, while the equal-weighted index matched the performance of the Mega-cap weighted index.

US Treasuries rallied across the curve with shorter-duration tenors, outperforming their longer-duration counterparts. The 2-year yield fell by nineteen basis points to 4.53%, while the 10-yield declined eight basis points to 4.18%. Surprisingly, yields dropped even with weak showings in the 2-year and 5-year auctions.

Oil prices rallied as conflict in the Middle East continued, and the hope for a ceasefire in Gaza anytime soon diminished. Talk that the upcoming OPEC+ meeting would result with continued production curbs also allied the rally. WTI gained 4.5% or $3.45 on the week to close at $79.97 a barrel. Gold prices gained 2.3% or $47.30 to close at $2095.50 an Oz. Copper prices fell by $0.02 to $3.86 per Lb. Notably, Bitcoin broke above the $60,000 level to close at $61,894, about $ 7,000 shy of its all-time high. The US dollar index changed little, going up 0.1% to 103.84.

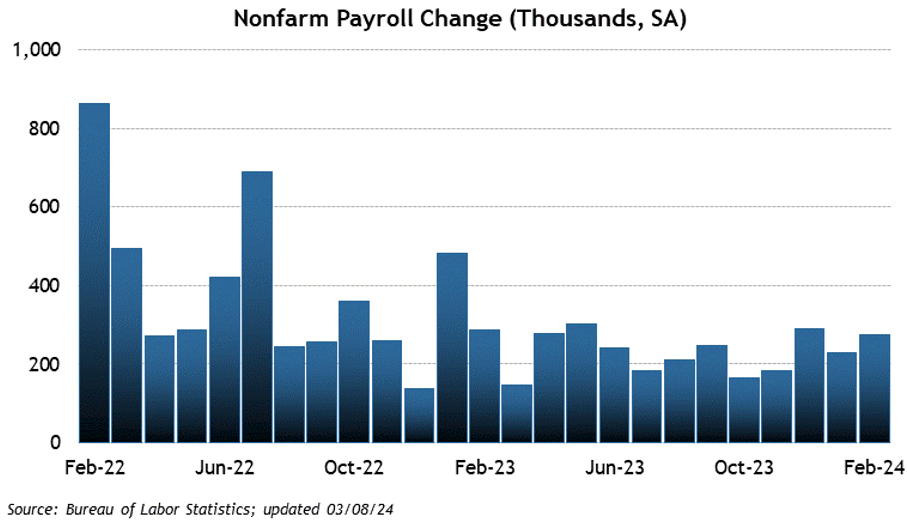

An Employment Situation Report fostered a soft landing narrative that saw massive downside revisions to the January figures, an uptick in the Unemployment rate, and a lighter increase in average hourly earnings. Non-farm payrolls came in at a robust 275k versus the consensus estimate of 195K. The January reading was revised downward from 353k to 229k. Similarly, Private Payrolls came in higher than expected at 223k, and the prior month's estimate was revised to 177k from 317k. The Unemployment rate ticked to 3.9%, which was higher than the anticipated rate of 3.7%. Average Hourly Earnings increased by 0.1% on a month-over-month basis, which was less than the expected 0.3% increase. The Average Workweek ticked a bit higher to 34.2 from the prior reading of 34.1. Initial Jobless claims for the week remained unchanged at 217k, while Continuing Claims increased by 8k to 1.96m. ISM Non-Manufacturing showed that services remained in an expansionary mode. However, the reading of 52.6% was less than the prior reading of 53.4%. The second reading for fourth-quarter productivity came in at 3.2%, while unit labor cost fell to 0.4% from 0.6%.

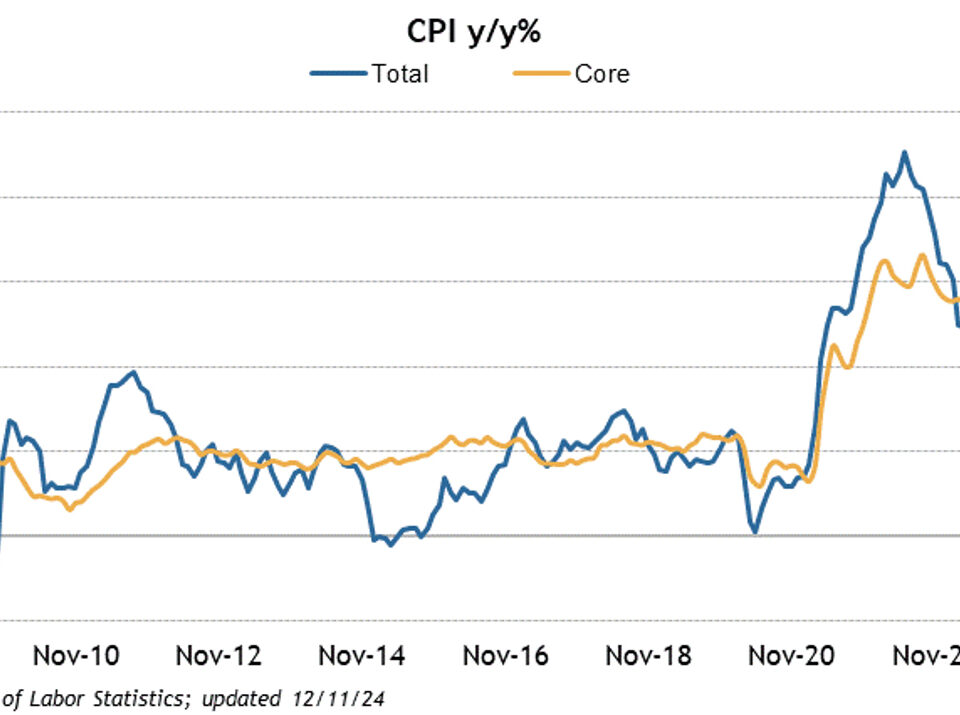

This week’s economic calendar will also be quite busy. Investors will examine February Consumer and Producer prices. We will also get a look at Retail Sales figures and Industrial production. The Treasury will also auction $117 billion in 3, 10, and 30-year paper.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.

Weekly Market Commentary – 12/30/24

Read more