Weekly Market Commentary – 5/24/24

May 24, 2024

Weekly Market Commentary – 6/14/24

June 14, 2024

The S&P 500 inked its twenty-fifth all-time high for the year, with outperformance coming from the mega-cap technology names. The Vanguard Mega-Cap Growth ETF was up 3.3% for the week. NVidia and AMD started the week with new product presentations that catalyzed their shares higher and propelled the semiconductor sector higher, too. NVidia’s market chaptalization surpassed three trillion dollars and overcame Apple as the 2nd largest company in the world. NVidia shares will be split ten for one on Monday. Notably, the largest ten companies in the S&P 500 now constitute 35% of the index the highest concentration since 1972.

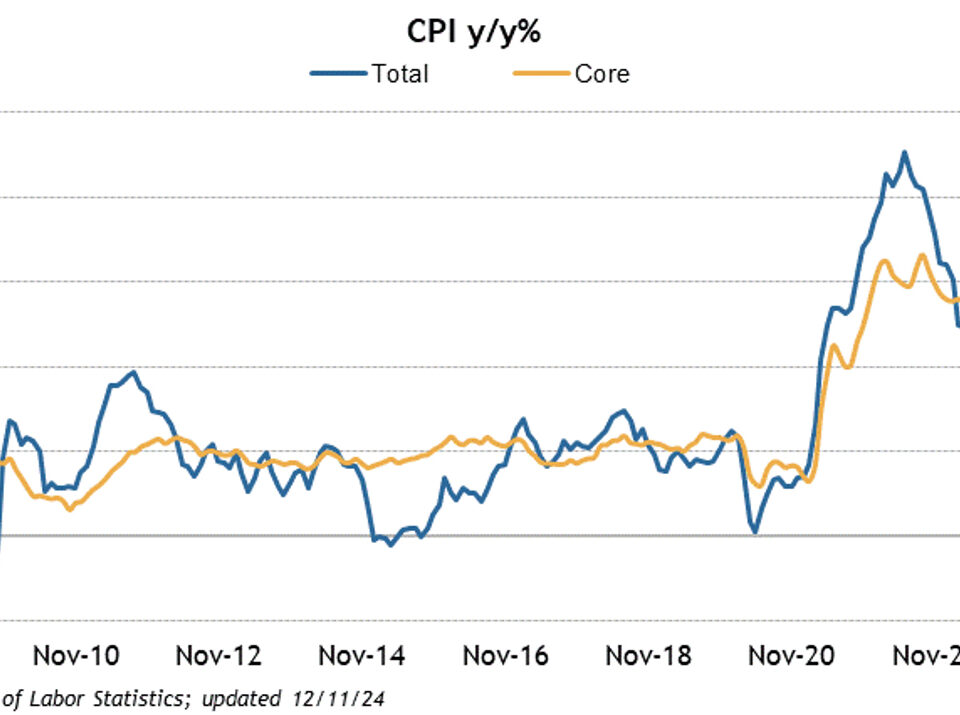

A mixed bag of economic data caused wild price moves in US Treasuries and expectations for changes in Federal Reserve monetary policy. Currently, the markets have priced in a 50% chance of a rate cut in September and an 86% chance in December. The European Central Bank, as expected, cut its policy rate by 25 basis points- the decision was met with very little market reaction. The Bank of Canada also lowered its policy rate by 25 basis points and indicated that there was room for more cuts if there was more progress on the inflation front. The Federal Reserve will meet this week, and it is widely expected to keep its policy rate unchanged at 5.25%-5.50%. The Fed will provide its most recent Summary of Economic Projections, which will provide clues on the future path of its monetary policy.

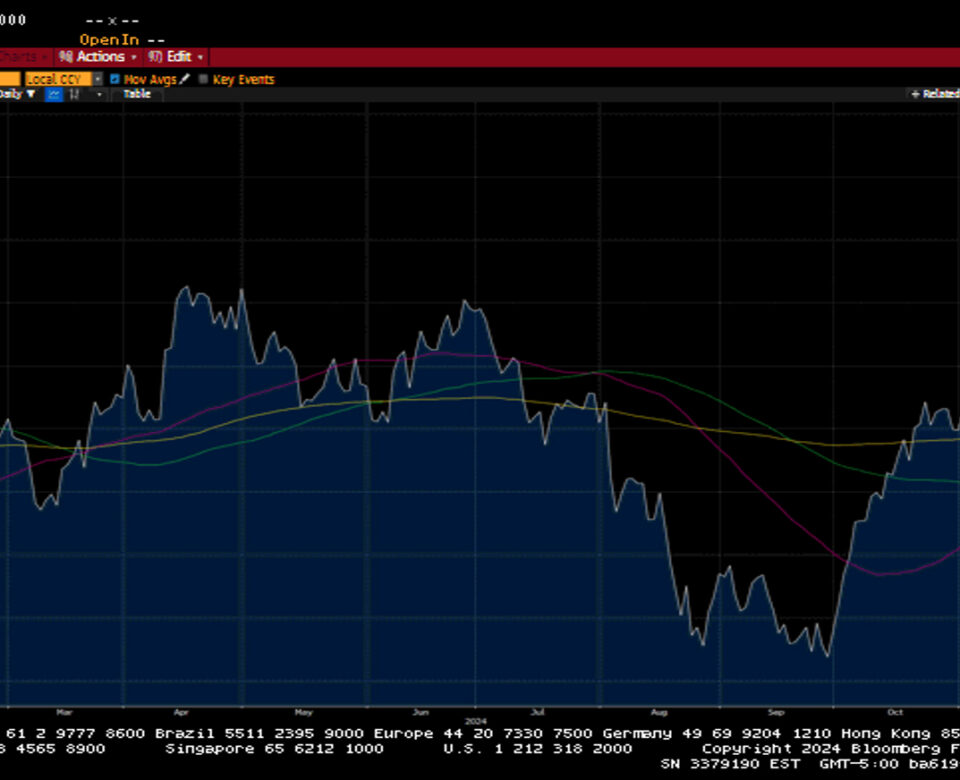

The S&P 500 gained 1.3%, the Dow inched higher by 0.3%, the NASDAQ increased by 2.4%, and the Russell 2000 fell by 2.1%. US Treasuries exhibited volatile trade as economic data released over the week painted a very different outlook. Treasuries started the week with yields coming off substantially but ended the week on a lower note after a strong Employment Situation report. The 2-year yield fell two basis points to 4.87%, while the 10-year yield fell eight basis points to 4.43%.

Oil prices fell by $1.58 or 2.1% to close at $75.50 after OPEC+ suggested they would normalize current production cuts this year, adding more supply to the market. Gold prices declined by $19.70, closing at $2323.90 an Oz. Copper prices fell for the third consecutive week, losing 2.8% to close at $4.45 per Lb. Bitcoin topped $71,000 but ended the week at ~$69,200. The US dollar index gained 0.3% and closed at 104.89.

The economic calendar was full and provided something for everyone. ISM Manufacturing showed a stronger contraction than expected, coming in at 48.7, below the prior reading of 49.2. ISM non-manufacturing came in hotter than expected, showing services expanding to 53.8 from 49.4. Of note, the prices paid component in the services number was much lower than the prior month. JOLTS data on job openings showed the fewest amount since 2021. Q1 productivity was slightly less than expected at 0.2%, as Unit Labor Costs declined from 4.7% to 4%. Initial Jobless Claims ticked higher by 8k to 229k. Continuing Claims increased by 2k to 1.792M. The Employment Situation report came in much stronger than anticipated and catalyzed a strong sell-off across the entire yield curve. Non-farm payrolls increased by 272k versus the consensus estimate of 185K. Private Payrolls grew by 229k, well above the expected 168k. The Unemployment rate rose to 4% from 3.9%, while Average Hourly Earnings increased more than expected at 0.4%. Over the last year, wages have increased by 4.1% versus 4% for the 12 months ending in April. Finally, the Average Workweek remained at 34.3 hours.

Weekly Market Commentary – 12/30/24

Read more